Buy USD Coin

Buy USD Coin safely and easily at one of Europe's leading exchanges.

Low trading fees: 0.25%

Buy USD Coin with 8 payment methods

USD Coin wallet included

* Be aware that digital assets are highly volatile and investing in digital assets can lead to partial or total loss of your investment. Carefully assess your own situation, conduct your own research and only invest in digital assets with money you can lose. Past performance is no indication of future performance.

400+

1.5M+

100B+

4/5

Intuitive Mobile App

Download our mobile app to buy cryptocurrency instantly from your phone. Manage your digital assets from your phone anytime, anywhere.

Legal Compliance

Bitvavo is registered with De Nederlandsche Bank (DNB), the Dutch Chamber of Commerce, and complies with all relevant legislation.

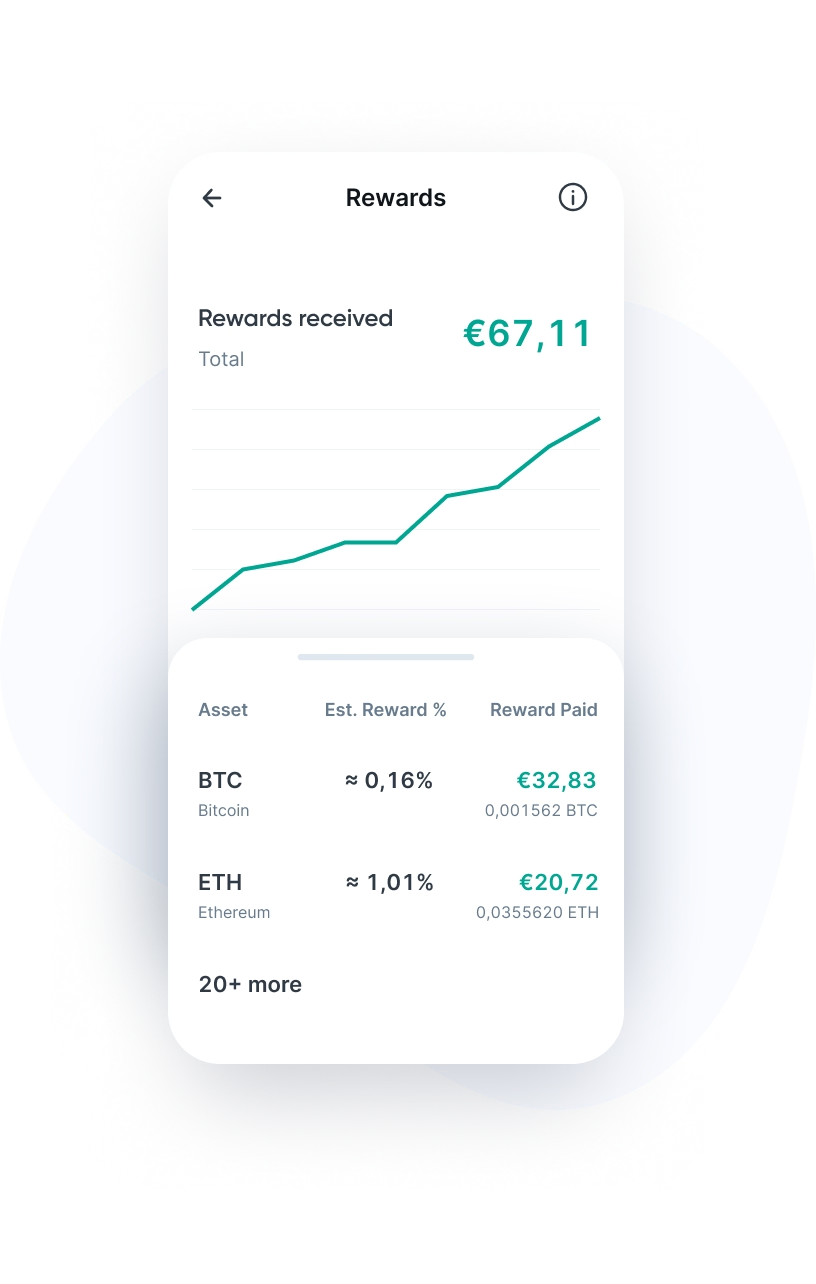

Staking Rewards

Bitvavo enables you to earn a return on your digital assets. Our staking service offers a yield of up to 15% on staked assets.

Frequently Asked Questions

Bitvavo makes USD Coin as easy as possible. Here are answers to common questions to help you make your first steps in the world of digital assets.

USD Coin is a stablecoin pegged one-to-one to the US dollar. Launched in 2018, it acts as a bridge between traditional finance and the crypto market. The goal of USDC is to provide a stable currency without the high volatility of other cryptocurrencies. This makes USD Coin attractive for value preservation and predictable transactions.

The value of USDC is backed by an equal amount of reserves in US dollars or related assets, such as US Treasury bonds. These reserves are held by regulated financial institutions in the United States. This ensures transparency and trust, as every USDC issued is backed by a real dollar. This makes USDC reliable as a store of value, a means of payment, and a unit of account.

In addition to providing predictable value, users also benefit from fast, cross-border transactions without intermediaries. USDC can be used for a wide range of products and services, including DeFi platforms where users can earn interest, take out loans, and use it as collateral.

Who founded USD Coin?

USD Coin was launched in 2018 by Centre, a partnership between Circle, a fintech company, and Coinbase, one of the world’s largest crypto exchanges. Both companies bring a lot of experience and are trusted in the industry, which benefits USD Coin.

USD Coin (USDC) has a wide range of features and applications, making it one of the most versatile cryptocurrencies. Here are some key features of USDC:

- Daily transactions: Due to its stable value, USDC can be used for everyday financial transactions, such as paying bills or making online purchases, without worrying about exchange rate fluctuations that affect other cryptocurrencies.

- Cross-border payments: Thanks to blockchain technology, USDC is ideal for making fast and cost-effective cross-border payments.

- DeFi platforms: USDC plays an important role in the DeFi ecosystem. Users can stake or borrow USDC on various DeFi platforms to earn interest or access liquidity.

- Volatility protection: Investors and traders can use USDC to protect the value of their portfolio from the volatility of the crypto market.

- Smart contracts and dApps: As an ERC-20 token, USDC can be integrated into smart contracts and dApps, allowing developers to create stable, dollar-based financial mechanisms within their projects.

USDC runs on at least 12 blockchains, including Ethereum, Tezos, Solana, and Avalanche, each with its own infrastructure and protocol. This is made possible by smart contracts on platforms like Ethereum, which regulate the issuance, transfer, and destruction of tokens.

For each blockchain on which USDC is available, USDC tokens are created, managed, and destroyed specifically for that network according to the rules and capabilities of that specific blockchain. This ensures broad interoperability and makes USDC accessible to a diverse range of users and applications.

Issuance and destruction of USDC tokens

New USDC tokens are created when users deposit US dollars into their Circle account. These dollars are then converted to USDC, with the deposited USD value being held securely. This serves as collateral for the issued USDC. Conversely, when USDC is exchanged for US dollars, the tokens are removed from circulation (burned) to maintain parity with the dollar.

Security and transparency

The security of USDC is ensured by a combination of technological and financial audits. The reserves that support USDC tokens are regularly audited by independent auditors to ensure that every token issued is fully backed. Additionally, the smart contracts that govern the operation of USDC are regularly audited to identify and address vulnerabilities.

In addition to security, transparency is a key feature of USDC. Centre regularly publishes reports on the status of reserves, allowing users and investors to verify the coverage and stability of USDC. This strengthens confidence in USDC as a reliable stablecoin.

USD Coin is known for its security. The project is backed by multiple security features and regular audits. Each USDC issued is directly pegged to a US dollar, meaning its value can always be kept at $1. The reserves are strictly managed and consist of cash or financial products with the same value, such as short-term US bonds.

USD Coin reserves are managed by regulated financial institutions, with Circle as the issuer publishing regular reports and subject to rigorous audits by external, international accounting firms such as Grant Thornton. This process ensures security and reliability, making USDC one of the safest stablecoins on the market.

USD Coin stands out from other cryptocurrencies and stablecoins due to a number of unique features and characteristics that make it a safe and stable choice. These include:

- A direct peg to the US Dollar: Unlike other cryptocurrencies, which are subject to volatility, USDC is directly pegged to the US dollar and maintains a constant value of $1 per USDC. This makes it a reliable means of payment and a secure store of value.

- Transparency and regulation: USDC is transparent and backed by regulated financial institutions. Unlike some other stablecoins where there are sometimes doubts about coverage, reserves, and regulatory compliance, USDC offers full transparency and regular audits.

- Broad adoption and interoperability: USD Coin can be used on multiple blockchains, making it one of the most interoperable stablecoins. This increases its usability, from traditional trading platforms to innovative DeFi applications and ecosystems.

- Backing by leading companies: USDC is backed by large and well-known financial technology companies such as Circle and Coinbase. These companies bring financial stability, innovation and confidence to the project.

Both USD Coin and Tether (USDT) are stablecoins that guarantee a stable value of $1, making them both important instruments for crypto traders looking to protect their value in the volatile crypto market.

The main difference between USD Coin and Tether lies in the transparency and management of their reserves. USDC is known for its high level of transparency and regular audits by reputable accounting firms, with each coin being backed by US dollars or equivalent assets.

Tether, on the other hand, has faced criticism in the past due to questions about the comprehensiveness of support for their issued coins and the frequency of their audits. While Tether is considered a secure stablecoin, USD Coin stands out as a more transparent alternative for crypto traders.

You can buy USD Coin (USDC) at Bitvavo. Our platform is suitable for both beginners and experienced traders. Follow these steps to buy USDC:

- Log in to your Bitvavo account or create a new account.

- Add money to your account via "Deposit".

- Go to the USD Coin (USDC) purchase page.

- Enter the desired euro amount to invest or the number of USDC coins you want to buy and click "Buy".

The price of USDC coins depends on the exact market value and the number of coins. Purchased USDC tokens are automatically placed in your Bitvavo wallet and are ready to use. Selling USDC is just as easy via Bitvavo, allowing you to respond quickly to your financial needs.

Bitvavo offers the ability to securely store your USDC tokens in your account, with most funds kept offline in secure cold wallets. We recommend using two-factor authentication (2FA) for added security.

For those who prefer to keep their USDC in a personal wallet, Bitvavo supports several software and hardware wallets that support USDC. After purchase, it is easy to move your USDC tokens to an external wallet, as long as the correct address is linked to your Bitvavo account.

* This is for informational purposes only and is not advice, nor should it be relied upon as such.

Direct Euro Transfers

Buying digital assets with Euros has never been easier. Bitvavo supports 8 payment methods, including SEPA for instant transfers.

Funding Methods →No Wallet Needed

Bitvavo manages your wallets and digital assets so you don't have to. Trade digital assets safely without technical knowledge.

Asset List →Security Features

Security is our top priority. Explore our security options and the measures we take to keep your account and our platform safe.

Our Security →Add USD Coin to your portfolio

Join over a million users buying and selling USD Coin at Bitvavo and enjoy our low fees and easy to use platform.

Sign up & Buy USD CoinBitvavo B.V.

Trading digital assets involves significant risks. Digital assets are highly volatile and you may lose some or all of your investment. The information on this page does not constitute advice, and should not be relied upon as such. Bitvavo is authorized as a crypto-asset service provider under Regulation (EU) 2023/1114 (MiCA) by the Autoriteit Financiële Markten (AFM), Vijzelgracht 50, 1017 HS Amsterdam. More info can be found in our Risk Disclosure.

Bitvavo is registered at the Dutch Chamber of Commerce, number 68743424.