Buy Synthetix

Buy Synthetix safely and easily at one of Europe's leading exchanges.

Low trading fees: 0.25%

Buy Synthetix with 8 payment methods

Synthetix wallet included

* Be aware that digital assets are highly volatile and investing in digital assets can lead to partial or total loss of your investment. Carefully assess your own situation, conduct your own research and only invest in digital assets with money you can lose. Past performance is no indication of future performance.

400+

1.5M+

100B+

4/5

Intuitive Mobile App

Download our mobile app to buy cryptocurrency instantly from your phone. Manage your digital assets from your phone anytime, anywhere.

Legal Compliance

Bitvavo is registered with De Nederlandsche Bank (DNB), the Dutch Chamber of Commerce, and complies with all relevant legislation.

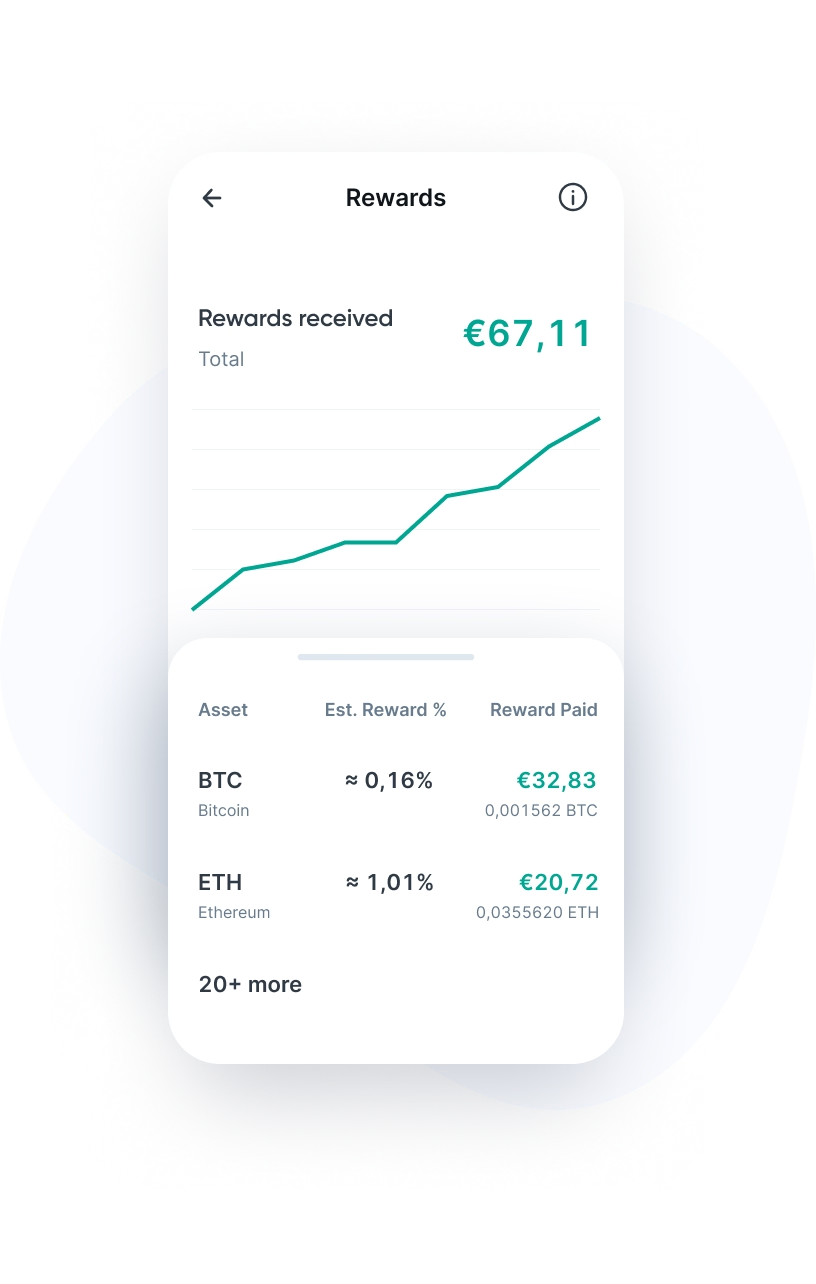

Staking Rewards

Bitvavo enables you to earn a return on your digital assets. Our staking service offers a yield of up to 15% on staked assets.

Frequently Asked Questions

Bitvavo makes Synthetix as easy as possible. Here are answers to common questions to help you make your first steps in the world of digital assets.

Synthetix is a Decentralized Finance (DeFi) platform focused on creating synthetic assets, also known as “synths.” These synths mimic the value of existing assets, such as fiat currencies, commodities, or cryptocurrencies, without users actually owning the underlying assets. This allows traders and investors to speculate on the price movements of these assets without actually entering the financial market.

Synthetix uses smart contracts on Ethereum to function autonomously and without the need for financial intermediaries. This means that no trust in individuals or institutions is required, while maximizing transparency and security for users.

The platform also facilitates trading in financial products such as futures and options, making Synthetix interesting for advanced traders who want to hedge or diversify their investments.

As a native token, SNX serves as the primary means of staking which is necessary for synth issuance. Stakers receive rewards in the form of transaction fees and new SNX tokens issued by the system.

Who founded Synthetix?

Synthetix was originally launched as Havven in 2017 by Kain Warwick and a few co-founders. After a successful Initial Coin Offering (ICO) in 2018 which raised $30 million, the project was renamed Synthetix. Synthetix is currently governed by three Decentralized Autonomous Organizations (DAOs), which ensure the democratic governance of the protocol.

Synthetix offers a variety of applications within the crypto and financial world. Here are some key features and use cases:

- Synth trading: Users can speculate on the price movements of synths that represent assets such as currencies, commodities, and other cryptocurrencies without physically owning them.

- Portfolio diversification: With access to different types of assets, Synthetix offers investors an easy way to diversify their investment portfolio.

- Risk management and hedging: Traders can limit their exposure to risk by taking positions in Synthetix that are opposite to their primary investments.

- Access to global markets: Synthetix enables users from anywhere in the world to gain exposure to markets that may otherwise be inaccessible due to geopolitical or economic barriers.

Synth creation is at the heart of the Synthetix platform. In order to create synths, a user must stake SNX tokens. These tokens are used as collateral to ensure the stability and value of the synths issued. The ratio of collateral to synth value (C-ratio) is essential to maintaining the financial health of the system. This ratio is therefore strictly controlled and regulated by the protocol.

The value of synths is maintained by oracles, which provide reliable and up-to-date price information to the Synthetix platform. These oracles allow off-chain data to be used on the blockchain, without the need for intermediaries.

Trading and liquidity

Synthetix also uses a unique peer-to-contract trading system, meaning traders can exchange synths directly without the need for traditional exchanges. This system relies on liquidity pools where stakers place their SNX, entitling them to trading fees and rewards.

Governance

Synthetix governance is managed by multiple DAOs which give voting rights to SNX holders. This structure ensures that all important decisions, such as changes to the protocol or updates, are made democratically by the community.

The SNX token serves several important roles within the ecosystem. As the platform’s native cryptocurrency, SNX is used for staking, which is essential for creating new synthetic assets, or synths. Stakers pledge their SNX as collateral to ensure the stability and reliability of the synths they issue, without the involvement of traditional financial institutions.

In addition to minting synths, SNX stakers receive rewards in the form of transaction fees generated by the network, and inflationary rewards designed to incentivize participation in the network.

In terms of tokenomics, Synthetix has a dynamic supply that is subject to changes due to annual inflation. The total number of tokens has increased from 100 million in 2019 to 260 million in 2023.

Synthetix is a unique platform with several distinguishing features:

- Decentralization of traditional financial markets: Synthetix enables trading of various traditional assets without intermediaries, thus decentralizing traditional financial markets.

- Access to various assets: Users can trade a wide range of products on Synthetix, from cryptocurrencies and fiat currencies to commodities and stocks.

- Flexible trading: Peer-to-contract trading, where users trade directly via smart contracts, enables the exchange of synths without waiting time, providing an efficient and instant trading experience.

- Incentive to contribute through rewards: SNX stakers receive transaction fees as a reward and benefit from the inflationary issuance of SNX, which incentivizes them to actively participate in the ecosystem for a long time.

- Innovative use of oracles: Synthetix integrates reliable price information via oracles, which are important for accurately tracking the value of synths.

You can buy Synthetix (SNX) at Bitvavo. Our exchange is accessible for both novice and experienced crypto traders. Follow these steps to buy SNX via our website or app:

- Log in to your Bitvavo account or register as a new user.

- Select "Deposit" to add money to your account.

- Visit the Synthetix (SNX) purchase page.

- Enter the amount in euros you wish to invest or the number of SNX tokens you want to buy, and confirm by clicking "Buy".

After following these steps, your SNX tokens are immediately visible in your personal Bitvavo wallet. Selling Synthetix is just as easy via our platform, so you can quickly respond to changes in the market.

At Bitvavo, you can safely store your Synthetix tokens. The majority of customer funds are stored offline in cold wallets, which guarantees maximum security. We recommend enabling two-factor authentication (2FA) as an additional layer of security.

Users can choose to store their SNX tokens in a personal software or hardware wallet. You must first link the external wallet address to your Bitvavo account to easily transfer your SNX tokens.

* This is for informational purposes only and is not advice, nor should it be relied upon as such.

Direct Euro Transfers

Buying digital assets with Euros has never been easier. Bitvavo supports 8 payment methods, including SEPA for instant transfers.

Funding Methods →No Wallet Needed

Bitvavo manages your wallets and digital assets so you don't have to. Trade digital assets safely without technical knowledge.

Asset List →Security Features

Security is our top priority. Explore our security options and the measures we take to keep your account and our platform safe.

Our Security →Add Synthetix to your portfolio

Join over a million users buying and selling Synthetix at Bitvavo and enjoy our low fees and easy to use platform.

Sign up & Buy SynthetixBitvavo B.V.

Trading digital assets involves significant risks. Digital assets are highly volatile and you may lose some or all of your investment. The information on this page does not constitute advice, and should not be relied upon as such. Bitvavo is authorized as a crypto-asset service provider under Regulation (EU) 2023/1114 (MiCA) by the Autoriteit Financiële Markten (AFM), Vijzelgracht 50, 1017 HS Amsterdam. More info can be found in our Risk Disclosure.

Bitvavo is registered at the Dutch Chamber of Commerce, number 68743424.