Buy Polymesh

Buy Polymesh safely and easily at one of Europe's leading exchanges.

Low trading fees: 0.25%

Buy Polymesh with 8 payment methods

Polymesh wallet included

* Be aware that digital assets are highly volatile and investing in digital assets can lead to partial or total loss of your investment. Carefully assess your own situation, conduct your own research and only invest in digital assets with money you can lose. Past performance is no indication of future performance.

400+

1.5M+

100B+

4/5

Intuitive Mobile App

Download our mobile app to buy cryptocurrency instantly from your phone. Manage your digital assets from your phone anytime, anywhere.

Legal Compliance

Bitvavo is registered with De Nederlandsche Bank (DNB), the Dutch Chamber of Commerce, and complies with all relevant legislation.

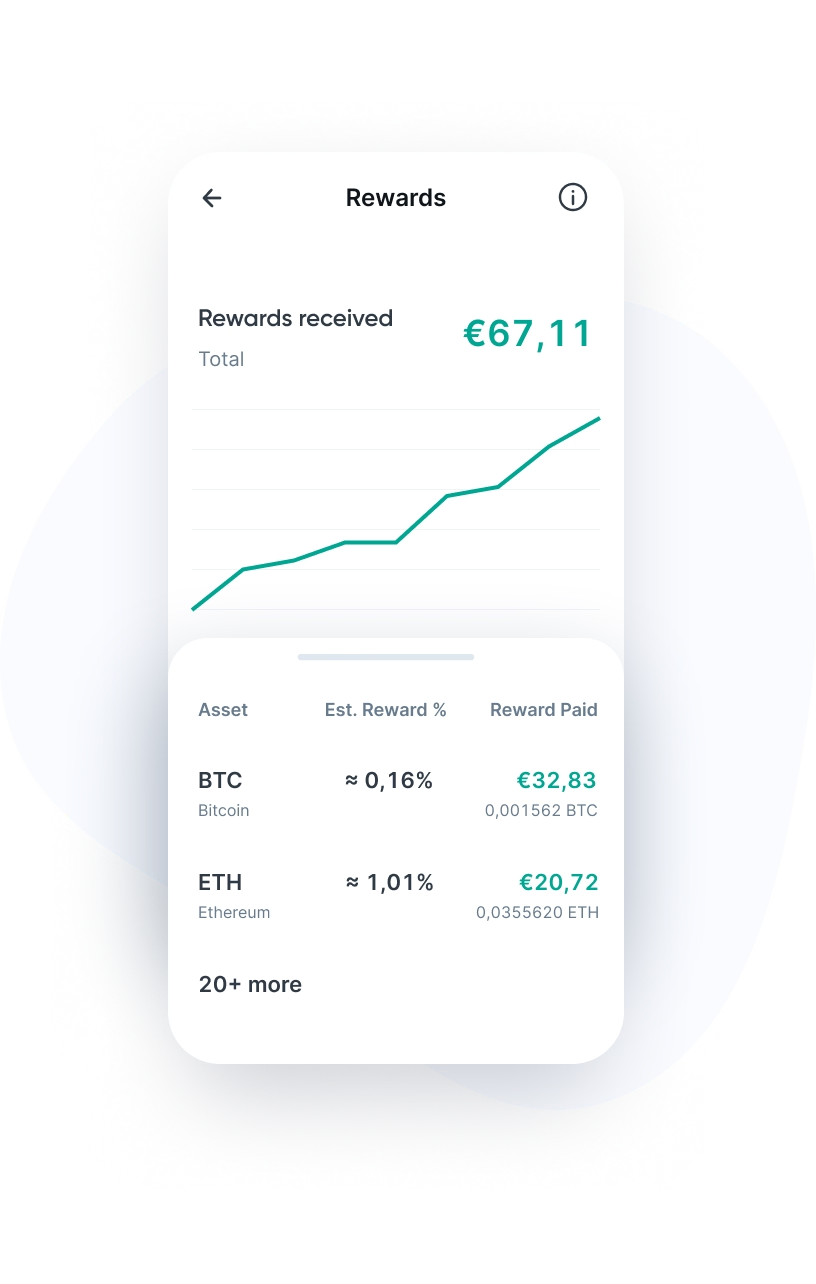

Staking Rewards

Bitvavo enables you to earn a return on your digital assets. Our staking service offers a yield of up to 15% on staked assets.

Frequently Asked Questions

Bitvavo makes Polymesh as easy as possible. Here are answers to common questions to help you make your first steps in the world of digital assets.

Polymesh is a blockchain specifically designed for security tokens. These tokens represent digital contracts that represent fractions of off-chain assets with real-world value. Polymesh is a public permissioned blockchain, meaning that anyone can view activity on the network, however active participation, such as issuing and trading tokens, requires identity verification.

What makes Polymesh unique is that it solves several problems that arise when managing security tokens on traditional blockchains, such as Ethereum. These problems relate to regulation, security, privacy and transaction speed. Polymesh enables traditional financial securities, such as stocks and bonds, to be issued and managed on the blockchain in a flexible and efficient way.

Users benefit from a number of specific advantages. First, Polymesh ensures a high level of compliance with global financial regulations, thanks to advanced smart contracts that can execute custom compliance rules. Second, Polymesh offers strong privacy protection using zero-knowledge proofs, allowing users to remain anonymous while still complying with regulations.

POLYX is the native token of Polymesh and plays a central role within the network. It is used to pay transaction fees, for staking, and for voting in the decentralized governance. POLYX also allows users to actively participate in the development and governance of the platform.

Who founded Polymesh?

Polymesh was developed by Polymath and founded by Trevor Koverko and Chris Housser. Known as a pioneer in the security token industry, Polymath launched Polymesh after finding that existing blockchains were not fully equipped to handle the complex demands of security token management. The team behind Polymesh consists of experts in blockchain technology, financial compliance, and cryptographic security.

Polymesh can be used in different situations due to the different features and products it offers:

- Security token issuance: Companies and individuals can issue security tokens that represent real assets, such as real estate, stocks or bonds.

- Security token trading: Polymesh facilitates the trading of security tokens between verified parties.

- Compliance management: The platform automates compliance, making it easier to comply with legal and regulatory requirements and laws.

- Staking: Stakers can stake their tokens on a validator, thereby contributing to the security and operation of the network while receiving rewards in the form of POLYX tokens.

Polymesh’s ecosystem consists of various entities, such as crypto exchanges like Polymath and companies with large security token portfolios like RedSwan. The platform encourages further contributions to the ecosystem through two programs:

- Grants Program: For individuals and companies developing open-source functionalities for Polymesh.

- Ecosystem Development Fund: For companies developing closed-source technology integrated with Polymesh.

Developers looking to use Polymesh can consult several resources, such as the Polymesh SDK library and a range of support channels.

Polymesh uses a Nominated Proof-of-Stake (NpoS) consensus mechanism, meaning that node operators are selected and supported by POLYX token holders. These nodes are responsible for validating transactions and maintaining the network. Validators must be licensed financial entities, which increases the security and reliability of the network.

Validators and stakers

Validators play an important role in the Polymesh network by verifying transactions and proposing blocks. These blocks must then be approved by a majority of other validators to be added to the blockchain. Stakers support validators by staking POLYX, which entitles them to a share of the rewards.

Governance

Polymesh’s governance is designed to prevent forks and ensure a stable and predictable operating environment. It includes the Governance Council, which consists of key stakeholders within the network. This council reviews system improvement proposals from token holders and votes on changes.

Identity verification and compliance

Every user who wants to actively participate must undergo a thorough identity check. This is essential to comply with global security laws that apply to the financial sector. Polymesh seamlessly integrates this identity data into its operational processes through the use of smart contracts. At the same time, it protects the privacy of users through cryptographic techniques.

Transaction finality

Polymesh provides near-instantaneous transaction finality, allowing financial transactions to be completed in seconds. This is a major advantage over traditional blockchains, where transactions can sometimes take hours to complete.

The POLYX token is the native token of the Polymesh network and plays an important role within the blockchain. First, POLYX serves as a means of payment for all transactions on the network, making it essential for issuing new security tokens and executing transactions. POLYX is also important for staking, where token holders can stake their tokens on validators to contribute to the security of the network and earn rewards. POLYX also gives token holders the right to vote on proposals regarding the future of the platform.

There are a total of 881.16 million POLYX tokens available. It is important to note that there is no set maximum supply, which means that the token supply may expand in the future.

The purpose of Polymesh alone makes it unique, however there are other reasons why Polymesh stands out from other blockchains, such as:

- Its limited access: Anyone can view the activity on the network, but active participation is only possible for verified users.

- Focus on security tokens: Unlike other blockchains, Polymesh is specifically designed to meet the requirements of managing security tokens, making it an ideal platform for financial services.

- Advanced compliance and identity verification: Polymesh complies with global regulations by implementing strict identity checks and compliance measures.

- Privacy and confidentiality: With technologies such as zero-knowledge proofs, Polymesh offers users privacy while still meeting strict compliance requirements.

- Fast and final transaction settlement: Polymesh ensures near-instant transaction finality, which is essential for financial services that require reliability and speed.

You can buy Polymesh (POLYX) at Bitvavo. Both novice and experienced crypto traders can use our exchange to buy POLYX. Follow these steps to buy POLYX coins via our website or app:

- Log in to your Bitvavo account or register as a new user.

- Choose "Deposit" to add money to your account.

- Go to the Polymesh (POLYX) purchase page.

- Enter how much euro you want to invest or how many POLYX tokens you wish to acquire, and confirm your purchase by clicking "Buy".

After following these steps, your POLYX tokens will be immediately visible in your personal Bitvavo wallet. Selling Polymesh coins is just as easy via Bitvavo, so you can quickly respond to price changes.

At Bitvavo, you can safely store Polymesh tokens. The majority of customer funds are stored offline in cold wallets for maximum security. We recommend enabling two-factor authentication (2FA) as an additional layer of security for your account.

Bitvavo offers users the possibility to store their POLYX tokens in their personal software or hardware wallet. To do this, the address of the external wallet must first be linked to Bitvavo, after which it is easy to transfer the POLYX tokens.

* This is for informational purposes only and is not advice, nor should it be relied upon as such.

Direct Euro Transfers

Buying digital assets with Euros has never been easier. Bitvavo supports 8 payment methods, including SEPA for instant transfers.

Funding Methods →No Wallet Needed

Bitvavo manages your wallets and digital assets so you don't have to. Trade digital assets safely without technical knowledge.

Asset List →Security Features

Security is our top priority. Explore our security options and the measures we take to keep your account and our platform safe.

Our Security →Add Polymesh to your portfolio

Join over a million users buying and selling Polymesh at Bitvavo and enjoy our low fees and easy to use platform.

Sign up & Buy PolymeshBitvavo B.V.

Trading digital assets involves significant risks. Digital assets are highly volatile and you may lose some or all of your investment. The information on this page does not constitute advice, and should not be relied upon as such. Bitvavo is authorized as a crypto-asset service provider under Regulation (EU) 2023/1114 (MiCA) by the Autoriteit Financiële Markten (AFM), Vijzelgracht 50, 1017 HS Amsterdam. More info can be found in our Risk Disclosure.

Bitvavo is registered at the Dutch Chamber of Commerce, number 68743424.