Buy Maverick Protocol

Buy Maverick Protocol safely and easily at one of Europe's leading exchanges.

Low trading fees: 0.25%

Buy Maverick Protocol with 8 payment methods

Maverick Protocol wallet included

* Be aware that digital assets are highly volatile and investing in digital assets can lead to partial or total loss of your investment. Carefully assess your own situation, conduct your own research and only invest in digital assets with money you can lose. Past performance is no indication of future performance.

400+

1.5M+

100B+

4/5

Intuitive Mobile App

Download our mobile app to buy cryptocurrency instantly from your phone. Manage your digital assets from your phone anytime, anywhere.

Legal Compliance

Bitvavo is registered with De Nederlandsche Bank (DNB), the Dutch Chamber of Commerce, and complies with all relevant legislation.

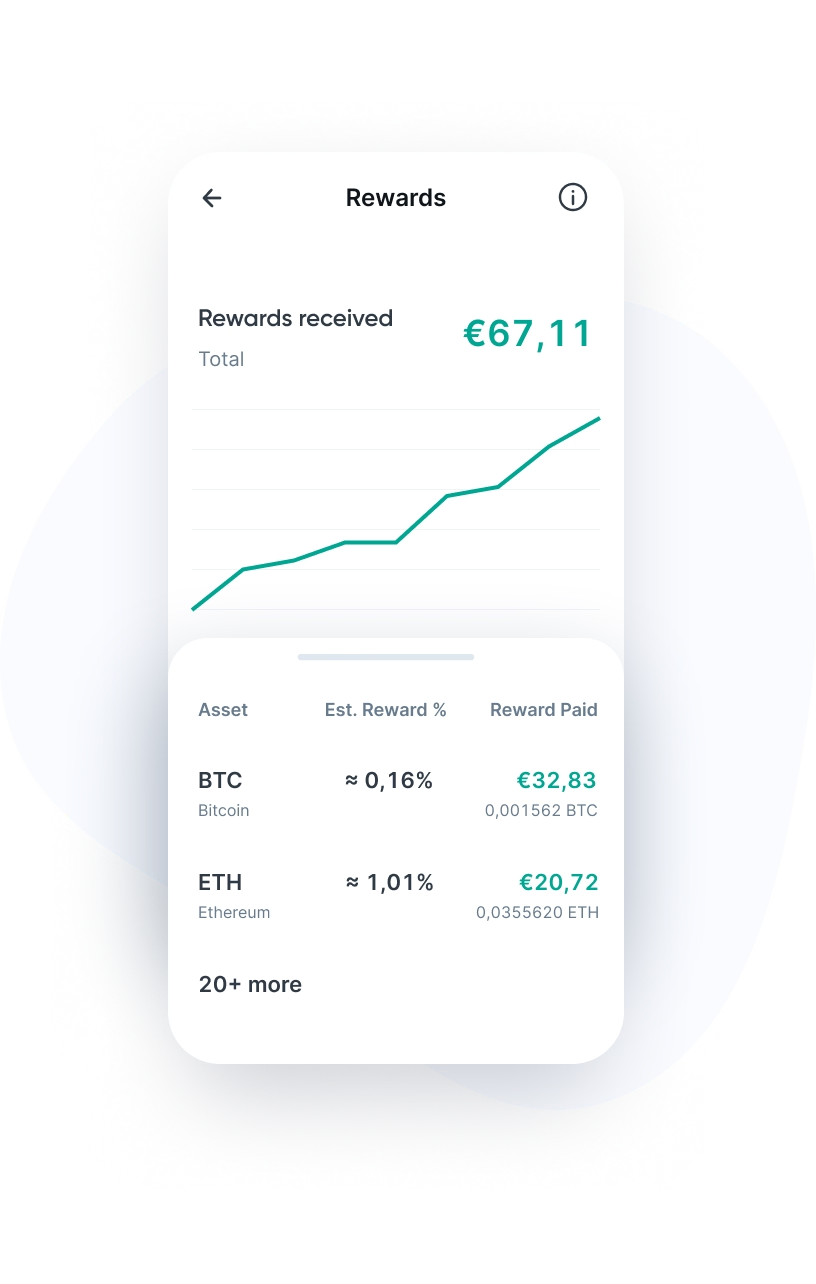

Staking Rewards

Bitvavo enables you to earn a return on your digital assets. Our staking service offers a yield of up to 15% on staked assets.

Frequently Asked Questions

Bitvavo makes Maverick Protocol as easy as possible. Here are answers to common questions to help you make your first steps in the world of digital assets.

Maverick Protocol (MAV) is a DeFi infrastructure protocol aimed at improving efficiency and liquidity within the sector. It introduces an innovative Automated Market Maker (AMM) that operates on both Ethereum and ZkSync Era, utilizing smart techniques to effectively manage and optimize liquidity. By allocating liquidity where it is most needed, Maverick Protocol eliminates traditional inefficiencies in DeFi. This leads to a better functioning and more efficient market for traders and liquidity providers.

What makes Maverick Protocol unique is its phase-oriented development path, with each phase addressing a specific aspect of DeFi inefficiencies:

- Phase 1: Introduction of the Dynamic Distribution AMM, aimed at improving capital efficiency. This AMM dynamically allocates liquidity across the market based on current market conditions, enabling users to deploy their capital more effectively and achieve optimal returns. This enhances the overall efficiency of the DeFi ecosystem.

- Phase 2: Launch of the Boosted Position feature, a tool that encourages targeted and effective liquidity provisioning. This allows users to direct their liquidity to specific price points in the market, contributing to a more stable and active market environment.

- Phase 3: Introduction of the ve-Model (voting escrow) and the meta-protocol design, allowing users to participate in governance and promoting long-term engagement within the ecosystem. This governance model ensures an engaged community that plays a role in shaping how the protocol evolves.

Maverick Protocol is backed by investors such as Founders Fund, Pantera Capital, and Coinbase Ventures. This support not only underscores the potential of the protocol to significantly impact the DeFi sector but also demonstrates the confidence these investors have in its vision and technology.

Who founded Maverick Protocol?

Maverick Protocol was founded by Alvin Xu and developed by a team with experience in blockchain and DeFi. The team is managed by GEAR, the overarching community responsible for governance decisions. The project has close ties with well-known investors and is supported by experienced players in the crypto industry, such as Pantera Capital and Founders Fund.

Maverick Protocol provides users with a range of features designed to optimize efficiency and liquidity within the DeFi sector. It enables them to effectively manage and grow capital through:

- Capital efficiency: The Dynamic Distribution AMM ensures optimal capital deployment in the market, allowing users to achieve effective returns.

- Liquidity provision: The Boosted Position feature encourages users to provide liquidity at strategic price points, enhancing market stability and activity.

- Secure asset storage: The protocol undergoes audits and offers on-chain monitoring, creating a safe environment for users.

- Governance and voting rights: Users can participate in the ve-Model, allowing them to vote on proposals and contribute to shaping the protocol's future.

Maverick Protocol's AMM algorithm is designed to maximize capital efficiency and effectively manage liquidity. It introduces directional liquidity pooling, allowing liquidity providers (LPs) to shift their liquidity based on expected asset price changes.

Directional liquidity pooling

The core of Maverick Protocol is the directional liquidity pooling, enabling LPs to determine the direction in which their liquidity moves, based on their market expectations. This approach ensures that liquidity remains within the active price range, allowing LPs to generate revenue without constantly adjusting their positions. The four modes are:

- Mode Right: For users with an optimistic outlook on the underlying assets. Liquidity shifts to the right during price increases and remains stable in case of decreases.

- Mode Left: For users expecting a downward price trend. Liquidity shifts to the left during price decreases and remains stable in case of increases.

- Mode Both: A bidirectional mode where liquidity moves along with price changes, both upwards and downwards. This increases the potential for revenue but also raises the risk of losses due to price fluctuations.

- Mode Static: A static mode similar to Uniswap v3's liquidity management, where liquidity remains within a fixed price range.

User- and developer-oriented features

In addition to directional pooling, Maverick Protocol offers various features for end-users and developers:

- Token issuers: Can set specific price points and add extra incentives for liquidity providers, increasing asset liquidity and stabilizing price levels for derivatives like stablecoins and ETH staking tokens.

- Boosted position Ttool: Enables LPs to earn both fee income and additional token rewards, making the platform appealing to active traders and developers.

The ve-Model and governance

The ve-Model grants users voting rights and the ability to stay involved in the protocol's development. By staking MAV tokens, users receive veMAV, which provides them with voting rights within the ecosystem. The GEAR governance ensures decentralization and transparency, as decisions are made by the community rather than individual administrators.

The MAV token is the native token of Maverick Protocol and has a maximum total supply of 2 billion tokens. MAV serves essential functions within the ecosystem, including facilitating governance, staking, and offering additional rewards. By staking MAV tokens in the ve-Model (voting escrow), users can acquire voting rights and thus influence the protocol's future. This encourages active participation in decision-making processes and contributes to a transparent, community-driven governance structure.

Users can earn MAV tokens by participating in liquidity provision and by completing specific tasks within the Maverick community, such as through the Warrior Incentive Program. Additionally, the MAV token is used to offer extra rewards in Boosted Position pools, making it more attractive for liquidity providers (LPs) to participate. In this way, MAV plays a central role in the growth and management of Maverick Protocol.

Maverick Protocol sets itself apart in the DeFi world with a range of unique features:

- Dynamic distribution AMM: Maverick introduces a completely new type of AMM that dynamically allocates liquidity based on real-time market conditions, significantly enhancing capital efficiency.

- Directional liquidity pooling: Instead of static liquidity management, Maverick allows LPs to direct their liquidity to specific price points, enabling them to respond flexibly to market fluctuations.

- Modes for liquidity movement: Users can choose from four unique modes (Mode Right, Left, Both, and Static) to strategically move their liquidity based on market expectations, allowing for an active and tailored market strategy.

- Boosted position tool for targeted incentives: The protocol offers liquidity providers a tool to shift liquidity to price points with additional rewards, encouraging strategic liquidity provision.

- Warrior incentive program for community engagement: Maverick actively engages its community through the Warrior Program, where users contribute to the protocol and are rewarded in return, strengthening the community and encouraging valuable contributions.

You can purchase Maverick Protocol (MAV) at Bitvavo. Our platform is accessible for both beginners and experienced traders. Follow these steps to buy MAV via our app or website:

- Log in or create a Bitvavo account.

- Click "Deposit" to add funds to your account.

- Go to the MAV token purchase page.

- Enter the amount in euros you wish to spend or the number of MAV tokens you want to acquire and click on "Buy".

Want to securely store your MAV tokens? You can easily do so within your Bitvavo account. Bitvavo uses a secure cold storage solution, keeping the majority of client funds offline. For added security, we recommend enabling two-factor authentication (2FA), so you enter a unique code in addition to your password when logging in.

Additionally, both software and hardware wallets provide secure options for storing MAV tokens. If you decide to transfer your MAV tokens to an external wallet, first verify the wallet address in your Bitvavo account. Then, you can quickly and easily send the tokens to your external wallet.

* This is for informational purposes only and is not advice, nor should it be relied upon as such.

Direct Euro Transfers

Buying digital assets with Euros has never been easier. Bitvavo supports 8 payment methods, including SEPA for instant transfers.

Funding Methods →No Wallet Needed

Bitvavo manages your wallets and digital assets so you don't have to. Trade digital assets safely without technical knowledge.

Asset List →Security Features

Security is our top priority. Explore our security options and the measures we take to keep your account and our platform safe.

Our Security →Add Maverick Protocol to your portfolio

Join over a million users buying and selling Maverick Protocol at Bitvavo and enjoy our low fees and easy to use platform.

Sign up & Buy Maverick ProtocolBitvavo B.V.

Trading digital assets involves significant risks. Digital assets are highly volatile and you may lose some or all of your investment. The information on this page does not constitute advice, and should not be relied upon as such. Bitvavo is authorized as a crypto-asset service provider under Regulation (EU) 2023/1114 (MiCA) by the Autoriteit Financiële Markten (AFM), Vijzelgracht 50, 1017 HS Amsterdam. More info can be found in our Risk Disclosure.

Bitvavo is registered at the Dutch Chamber of Commerce, number 68743424.