Buy Lido DAO

Buy Lido DAO safely and easily at one of Europe's leading exchanges.

Low trading fees: 0.25%

Buy Lido DAO with 8 payment methods

Lido DAO wallet included

* Be aware that digital assets are highly volatile and investing in digital assets can lead to partial or total loss of your investment. Carefully assess your own situation, conduct your own research and only invest in digital assets with money you can lose. Past performance is no indication of future performance.

400+

1.5M+

100B+

4/5

Intuitive Mobile App

Download our mobile app to buy cryptocurrency instantly from your phone. Manage your digital assets from your phone anytime, anywhere.

Legal Compliance

Bitvavo is registered with De Nederlandsche Bank (DNB), the Dutch Chamber of Commerce, and complies with all relevant legislation.

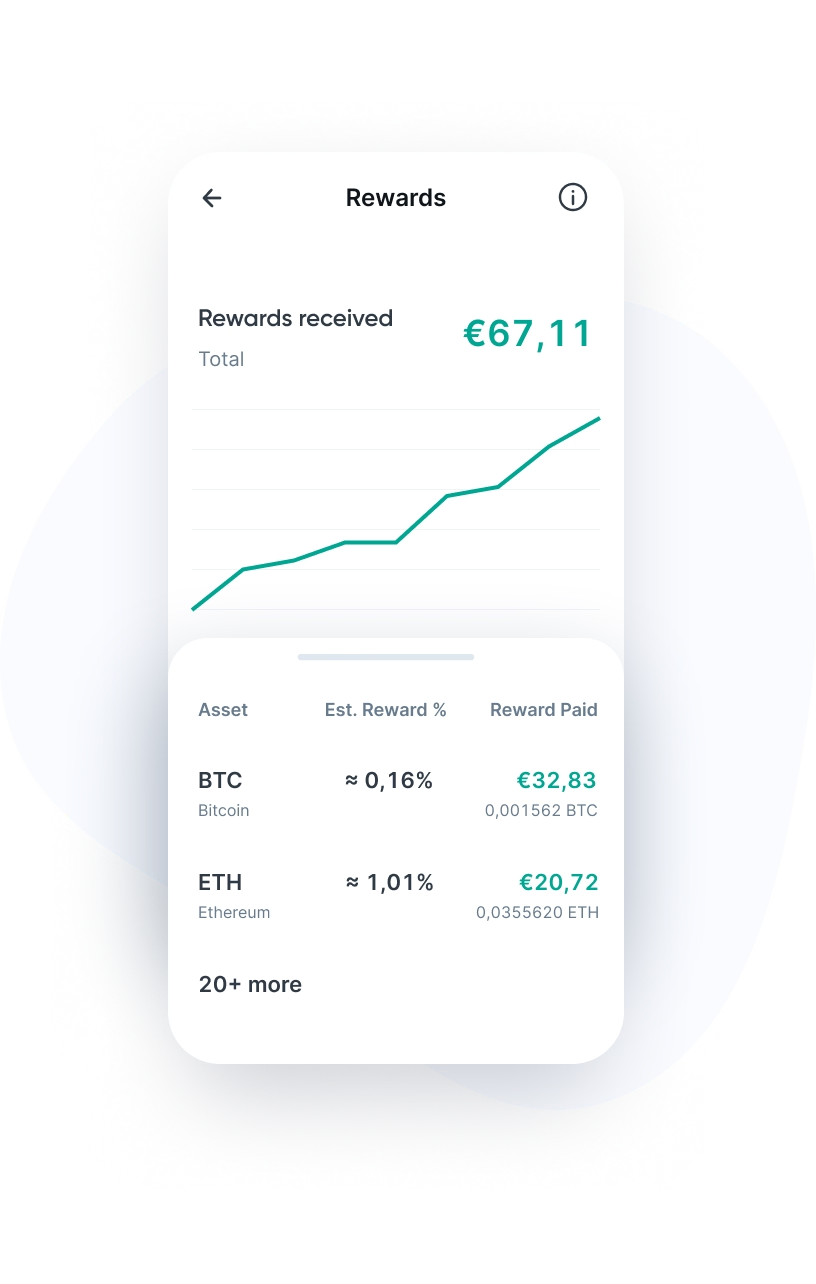

Staking Rewards

Bitvavo enables you to earn a return on your digital assets. Our staking service offers a yield of up to 15% on staked assets.

Frequently Asked Questions

Bitvavo makes Lido DAO as easy as possible. Here are answers to common questions to help you make your first steps in the world of digital assets.

Lido DAO (LDO) is a Decentralized Autonomous Organization (DAO) and a liquid staking protocol that enables users to stake their cryptocurrency without fully locking it. This sets Lido apart from traditional Proof-of-Stake (PoS) networks, where tokens are often locked for extended periods, limiting token liquidity. Lido offers an innovative solution by providing stakers with a liquid staking option. In this system, they receive a 1:1 token (stToken) for their staked assets, which is freely tradable and can be used in other DeFi protocols while the staked tokens continue to generate interest.

The core role of Lido DAO is to make staking more accessible for everyone. Typically, a user needs at least 32 ETH in the Ethereum network to operate as a validator, a high threshold for many investors. Lido lowers this barrier by allowing users to stake any amount of ETH while keeping their tokens liquid through the stETH token. stETH represents the staked ETH and can be used in various decentralized applications (dApps) and DeFi protocols, such as Aave, Curve, and Uniswap.

Lido supports not only Ethereum but also other popular Proof of Stake blockchains such as Polygon, Solana, and Polkadot. For each of these networks, Lido provides liquid staking tokens that have the same functionality as stETH. For example, users receive stMATIC for Polygon or stSOL for Solana.

What makes Lido unique is that it not only provides liquidity to stakers but also contributes to the decentralization and security of the network. Lido works with multiple node operators who handle the validation of transactions within the network. These node operators are reviewed and approved by the community through the Lido DAO, which makes the network resilient and reduces the chances of errors or attacks.

Lido's liquid staking solution has significantly impacted the crypto market, particularly within the Ethereum ecosystem. Approximately 30% of all staked ETH is staked via Lido, highlighting the protocol's importance for both small and large investors.

LDO is the governance token of Lido. It provides holders with voting rights within the DAO, enabling them to influence the project's direction, such as altering fees, adding new node operators, or adjusting protocol parameters. The more LDO a user owns, the greater their voting power.

Who are the founders of Lido DAO?

Lido DAO was launched in October 2020 by a team of experienced crypto specialists, including Konstantin Lomashuk, Vasiliy Shapovalov, and Jordan Fish (also known as "Cobie"). Lomashuk is the founder and CEO of P2P Validator, a non-custodial staking service that has been active since 2018 and manages billions in assets. Shapovalov is the CTO of P2P Validator and played a key role in the technical development of Lido.

Although Cobie is no longer actively involved in the project, his contribution was crucial in the early development of Lido. Today, the project is managed by the Lido DAO, a decentralized organization where decisions are made by the community.

Lido offers both individual users and developers a range of features that simplify participation in staking and leveraging decentralized applications:

- Staking with no minimum requirement: Users can stake their digital assets without meeting the minimum requirements of blockchains, such as the 32 ETH typically needed for staking on Ethereum.

- Liquid staking: With liquid staking, users receive an stToken representing their staked assets, and this token can be freely used in DeFi protocols.

- Decentralization and security: Lido distributes staked assets across multiple nodes, ensuring a safe and robust network.

- DeFi compatibility: Lido's stTokens can be used for yield farming, providing liquidity, and lending in various DeFi applications, such as Aave and Uniswap.

When a user stakes their assets via Lido, they receive a 1:1 token, known as an stToken (e.g., stETH for Ethereum). This token represents the staked assets in the network and continues to generate interest, just like traditional staking. The main difference is that stTokens are freely tradable and can be used across various DeFi protocols.

stTokens act as a type of proxy for the underlying staked assets. This enables users to deploy their stTokens for applications like yield farming, without affecting the original staked tokens. Thanks to Lido's liquid staking mechanism, users can also quickly swap their tokens without waiting for the unstaking period, which can take days to weeks on some networks.

Token distribution and node operators

Lido distributes the staked assets across a group of approved node operators who validate transactions and ensure network security. For instance, in the case of Ethereum, the staked ETH tokens are distributed in batches of 32 ETH, which are allocated to different validators. This reduces the risk of centralization and enhances network security.

Node operators are selected and approved by the Lido community via the DAO. The community votes on which operators are reliable enough to participate in the network. Each operator must meet strict criteria to be accepted, which minimizes risks for users.

Governance and the LDO token

The LDO token plays a crucial role in the governance system of Lido DAO. LDO holders have voting rights within the DAO and can decide on important matters such as adding new node operators, adjusting staking fees, and granting subsidies to developers. The more LDO a user owns, the greater their influence within the DAO.

Additionally, Lido DAO manages an insurance and development fund to secure the future of the protocol and support the community.

LDO is the governance token of Lido DAO, which means holders have voting rights within the decentralized organization. This allows them to vote on decisions related to the Lido protocol, such as approving new node operators, adjusting staking fees, and determining the project's direction. The voting weight is determined by the amount of LDO a user owns. In addition to governance, LDO also plays a role in rewarding validators and other contributions within the ecosystem.

The maximum supply of LDO tokens is set at 1 billion. A portion of these tokens is allocated to the community, while other sections are reserved for developers, validators, and investors. A significant percentage of the total supply is already in circulation, while the remaining tokens are held in the Lido DAO Treasury or subject to lock-up periods.

Staking LDO differs from liquid staking of cryptocurrencies like Ethereum. LDO is primarily used for governance within the Lido DAO and cannot be staked in the same manner as, for example, stETH. However, LDO holders can "lock" their tokens in voting contracts to participate in the protocol's governance and influence important decisions.

Users who want to contribute to the governance of Lido can stake their LDO via the DAO governance system. This grants them voting rights and allows them to be actively involved in the decision-making that further shapes the Lido protocol.

Lido distinguishes itself from other crypto and blockchain projects with several unique features that make the protocol attractive to stakers and DeFi users:

- Liquid staking: Lido allows users to stake their digital assets without locking them up. This enables them to continue participating in DeFi applications while maintaining their liquidity.

- No minimum staking requirement: Lido enables staking of any amount of crypto assets, unlike many blockchains that have a high minimum threshold, such as 32 ETH on Ethereum.

- Decentralized governance: The Lido protocol is managed by a DAO, where LDO holders have voting rights on decisions like adding new node operators and adjusting staking fees.

- Multichain support: Lido not only supports Ethereum but also other networks such as Polygon, Solana, and Polkadot, making it appealing to users active on various blockchains.

- Fast access to staked assets: Users can swap or trade their stTokens at any time, without having to endure the long unstaking periods common in PoS networks.

Buying Lido DAO (LDO) is possible through Bitvavo. Both novice and experienced crypto traders can purchase LDO via our website or app. Follow the steps below to quickly buy LDO:

- Register or log in to your Bitvavo account.

- Transfer funds by clicking "Deposit".

- Go to the Lido DAO purchase page.

- Enter the amount you want to invest, or the number of LDO tokens you wish to purchase, and click "Buy".

After purchase, the LDO tokens are immediately added to your Bitvavo account, and the price is always linked to the current market rate. This allows you to quickly respond to market movements and easily manage your tokens.

You can safely store your LDO tokens in your Bitvavo account. The majority of customer assets are kept in cold storage, providing extra security. We also recommend enabling two-factor authentication (2FA) for additional protection when logging in.

Want to transfer your LDO to an external wallet? Carefully add the wallet address to your Bitvavo account before you can transfer the tokens. This process is quick and straightforward, after which you can store your tokens in almost any hardware or software wallet that supports LDO.

* This is for informational purposes only and is not advice, nor should it be relied upon as such.

Direct Euro Transfers

Buying digital assets with Euros has never been easier. Bitvavo supports 8 payment methods, including SEPA for instant transfers.

Funding Methods →No Wallet Needed

Bitvavo manages your wallets and digital assets so you don't have to. Trade digital assets safely without technical knowledge.

Asset List →Security Features

Security is our top priority. Explore our security options and the measures we take to keep your account and our platform safe.

Our Security →Add Lido DAO to your portfolio

Join over a million users buying and selling Lido DAO at Bitvavo and enjoy our low fees and easy to use platform.

Sign up & Buy Lido DAOBitvavo B.V.

Trading digital assets involves significant risks. Digital assets are highly volatile and you may lose some or all of your investment. The information on this page does not constitute advice, and should not be relied upon as such. Bitvavo is authorized as a crypto-asset service provider under Regulation (EU) 2023/1114 (MiCA) by the Autoriteit Financiële Markten (AFM), Vijzelgracht 50, 1017 HS Amsterdam. More info can be found in our Risk Disclosure.

Bitvavo is registered at the Dutch Chamber of Commerce, number 68743424.