Buy IDEX

Buy IDEX safely and easily at one of Europe's leading exchanges.

Low trading fees: 0.25%

Buy IDEX with 8 payment methods

IDEX wallet included

* Be aware that digital assets are highly volatile and investing in digital assets can lead to partial or total loss of your investment. Carefully assess your own situation, conduct your own research and only invest in digital assets with money you can lose. Past performance is no indication of future performance.

400+

1.5M+

100B+

4/5

Intuitive Mobile App

Download our mobile app to buy cryptocurrency instantly from your phone. Manage your digital assets from your phone anytime, anywhere.

Legal Compliance

Bitvavo is registered with De Nederlandsche Bank (DNB), the Dutch Chamber of Commerce, and complies with all relevant legislation.

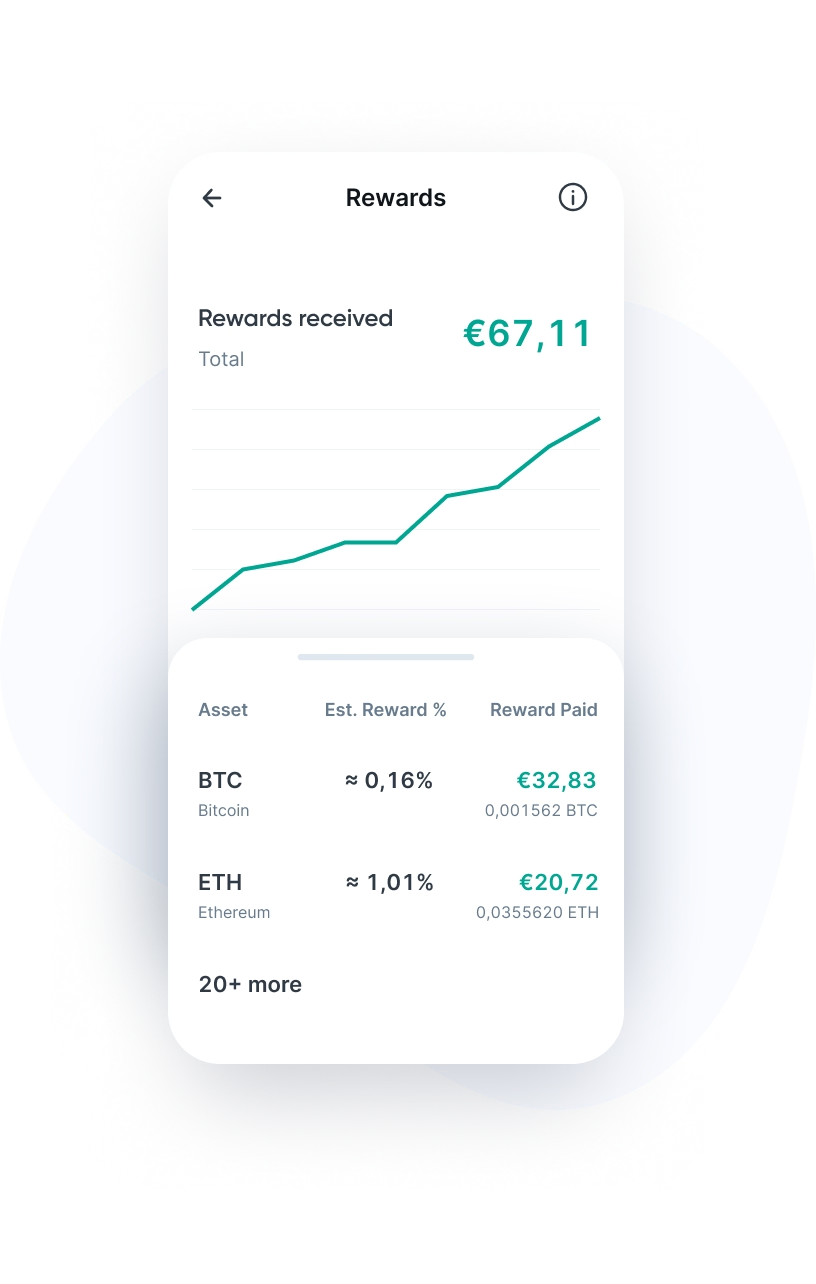

Staking Rewards

Bitvavo enables you to earn a return on your digital assets. Our staking service offers a yield of up to 15% on staked assets.

Frequently Asked Questions

Bitvavo makes IDEX as easy as possible. Here are answers to common questions to help you make your first steps in the world of digital assets.

Idex is a hybrid decentralized exchange (DEX) that combines the benefits of an order book model with an Automated Market Maker (AMM). The platform operates on both Ethereum and Binance Smart Chain, offering a mix of speed and decentralization. Unlike most DEXs, which rely fully on AMMs, Idex uses an order book model for a more efficient and affordable trading experience, allowing users to trade without failed transactions or wasted gas fees.

A significant advantage of Idex is the immediate execution of transactions. Many decentralized exchanges suffer from delays and front-running (unfair competition), but Idex prevents this with an off-chain matching engine that processes orders instantly. Transactions do not have to wait for previous transactions to be completed, enabling advanced order types and trading strategies, such as limit orders and arbitrage.

Idex focuses on a multichain future. In addition to Ethereum and Binance Smart Chain, the platform is working on integrations with Polkadot and other layer 2 solutions to further expand its functionality. This enables users to ultimately trade across multiple blockchains through a single interface. Idex also plans to add leveraged trading and become available on more blockchains.

Idex utilizes smart contracts for fund custody and transaction settlement. Instead of operating entirely on-chain, Idex employs a hybrid approach where transactions are first processed off-chain and then settled on-chain. This structure provides the speed and efficiency of centralized exchanges, combined with the security and transparency of a DEX. Users always maintain full control over their funds, and the smart contracts ensure that funds are only moved after a successful transfer.

Who founded Idex?

Idex was founded in 2017 by Alex Wearn and his brother Phil Wearn. Alex Wearn, the CEO, has experience at companies such as Amazon, IBM, and Adobe and holds an MBA from the Kellogg School of Management. Phil Wearn, the COO, has a background in accounting and aerospace engineering, with additional entrepreneurial experience. Under the leadership of the Wearn brothers, the Idex team has grown to 29 employees, including experienced software engineers like CTO Brian Yennie. Over the years, Idex has also attracted significant investments, including $2.5 million in 2020.

Idex offers a versatile set of features that aids both beginners and experienced traders in trading efficiently and securely:

- Trading without waiting time: With instant execution, users can trade without waiting for settlement, which is especially useful for frequent traders.

- Advanced order types: Support for limit orders, stop-loss, and fill-or-kill, enabling advanced trading strategies.

- Liquidity via AMM and order book: Idex combines AMM liquidity with an order book, allowing traders to benefit from both models and find better prices.

- Staking and validation: Users can stake IDEX tokens to contribute to network validation, receiving rewards as compensation.

- Multichain support: Idex operates on Ethereum, Binance Smart Chain, and Polkadot, with plans for further integrations, offering users access to various blockchains.

Idex operates on a hybrid model using a combination of on-chain and off-chain processes to handle transactions faster and more efficiently. The off-chain trading engine of Idex processes and matches orders outside of the blockchain. This prevents network fees when placing or canceling orders, which is particularly beneficial for active traders. The engine operates in real-time and can quickly match orders without the delays often occurring with blockchain transactions. Only when a trade is matched and confirmed, is the transaction settled on-chain.

Order book with AMM integration

Idex combines a traditional order book with an Automated Market Maker (AMM). This means that users can benefit not only from limit orders but also from the liquidity provided by the AMM. Virtual limit orders, created by the AMM, appear alongside real limit orders in the order book, increasing the platform's liquidity and offering traders better buy or sell prices.

Smart contracts for fund custodianship and settlement

Idex's smart contracts play a critical role in fund custody and settlement. These contracts hold user funds in escrow and ensure that transactions are only executed after successful off-chain matching and a brief on-chain settlement period. With this approach, user funds remain under their control until the settlement is complete, ensuring security and control over their assets.

Layer 2 solutions for scalability

To promote scalability and minimize transaction costs, Idex utilizes layer 2 solutions like Optimistic Rollups. This is particularly useful on Ethereum, where high gas fees and network congestion can be an issue. With Optimistic Rollups, transactions are processed off-chain and later validated on-chain. This not only increases speed but also keeps costs low, enabling Idex to maintain high transaction speeds without sacrificing decentralization.

As a utility token, IDEX provides users with multiple opportunities, such as staking and rewards, and supports transaction validation within the network. Users can stake IDEX to support the network, for which they receive staking rewards. Additionally, the IDEX token serves as a payment method on the platform, making it a crucial part of the exchange's trading infrastructure.

The total supply of IDEX tokens is limited to 1 billion tokens. A significant portion is reserved for market development and market maker rewards. The distribution is carefully designed: 40% of the tokens are allocated for rewards and marketing, 25% for the team, and the remainder for future developments and operational costs. With this strategy, IDEX aims to create a stable token circulation to support platform growth.

Idex offers several unique features that give the platform an edge in the world of decentralized exchanges. These features are specifically designed to provide users with an innovative and powerful trading environment:

- Hybrid structure for enhanced trading experience: Idex combines the efficiency of a centralized order-matching engine with the security of decentralized settlement, ensuring instant execution of transactions without high gas fees.

- No failed transactions or wasted costs: Thanks to the hybrid architecture, users can place and cancel orders without the risk of failed transactions or wasted costs, which is unique for a DEX with an order book model.

- Advanced trading options with guaranteed order sequence: Idex provides advanced order types like limit orders, fill-or-kill, and post-only, with a structured transaction sequence that prevents unnecessary market disruptions.

- Smart contracts with temporary escrow features: The smart contracts of Idex offer temporary escrow for funds, allowing users full control over their assets without compromising security during settlement.

- Multichain support with easy access: Idex operates on multiple blockchains, such as Ethereum, Binance Smart Chain, and Polkadot, and is ready for further integration. This provides users access to a wide range of digital assets without leaving the platform.

At Bitvavo, you can purchase IDEX. The Bitvavo platform is suitable for both beginner and experienced traders. Follow these steps to buy IDEX through our website or app:

- Sign up or log in to your Bitvavo account.

- Make a deposit by clicking "Deposit".

- Go to the purchase page of Idex (IDEX).

- Enter the amount in euros you wish to invest or the number of IDEX tokens you want to buy and click "Buy".

Want to securely store your Idex tokens? Within your Bitvavo account, your funds are well protected; the majority of customer funds are kept in offline cold storage. For added security, you can enable two-factor authentication (2FA), so you enter an extra code alongside your password when logging in.

You can also choose to store your IDEX in a software or hardware wallet. Want to transfer tokens to an external wallet? Simply verify the wallet address in your Bitvavo account to ensure a secure transfer. This way, you can manage and store your IDEX with peace of mind.

* This is for informational purposes only and is not advice, nor should it be relied upon as such.

Direct Euro Transfers

Buying digital assets with Euros has never been easier. Bitvavo supports 8 payment methods, including SEPA for instant transfers.

Funding Methods →No Wallet Needed

Bitvavo manages your wallets and digital assets so you don't have to. Trade digital assets safely without technical knowledge.

Asset List →Security Features

Security is our top priority. Explore our security options and the measures we take to keep your account and our platform safe.

Our Security →Add IDEX to your portfolio

Join over a million users buying and selling IDEX at Bitvavo and enjoy our low fees and easy to use platform.

Sign up & Buy IDEXBitvavo B.V.

Trading digital assets involves significant risks. Digital assets are highly volatile and you may lose some or all of your investment. The information on this page does not constitute advice, and should not be relied upon as such. Bitvavo is authorized as a crypto-asset service provider under Regulation (EU) 2023/1114 (MiCA) by the Autoriteit Financiële Markten (AFM), Vijzelgracht 50, 1017 HS Amsterdam. More info can be found in our Risk Disclosure.

Bitvavo is registered at the Dutch Chamber of Commerce, number 68743424.