Buy GMX

Buy GMX safely and easily at one of Europe's leading exchanges.

Low trading fees: 0.25%

Buy GMX with 8 payment methods

GMX wallet included

* Be aware that digital assets are highly volatile and investing in digital assets can lead to partial or total loss of your investment. Carefully assess your own situation, conduct your own research and only invest in digital assets with money you can lose. Past performance is no indication of future performance.

400+

1.5M+

100B+

4/5

Intuitive Mobile App

Download our mobile app to buy cryptocurrency instantly from your phone. Manage your digital assets from your phone anytime, anywhere.

Legal Compliance

Bitvavo is registered with De Nederlandsche Bank (DNB), the Dutch Chamber of Commerce, and complies with all relevant legislation.

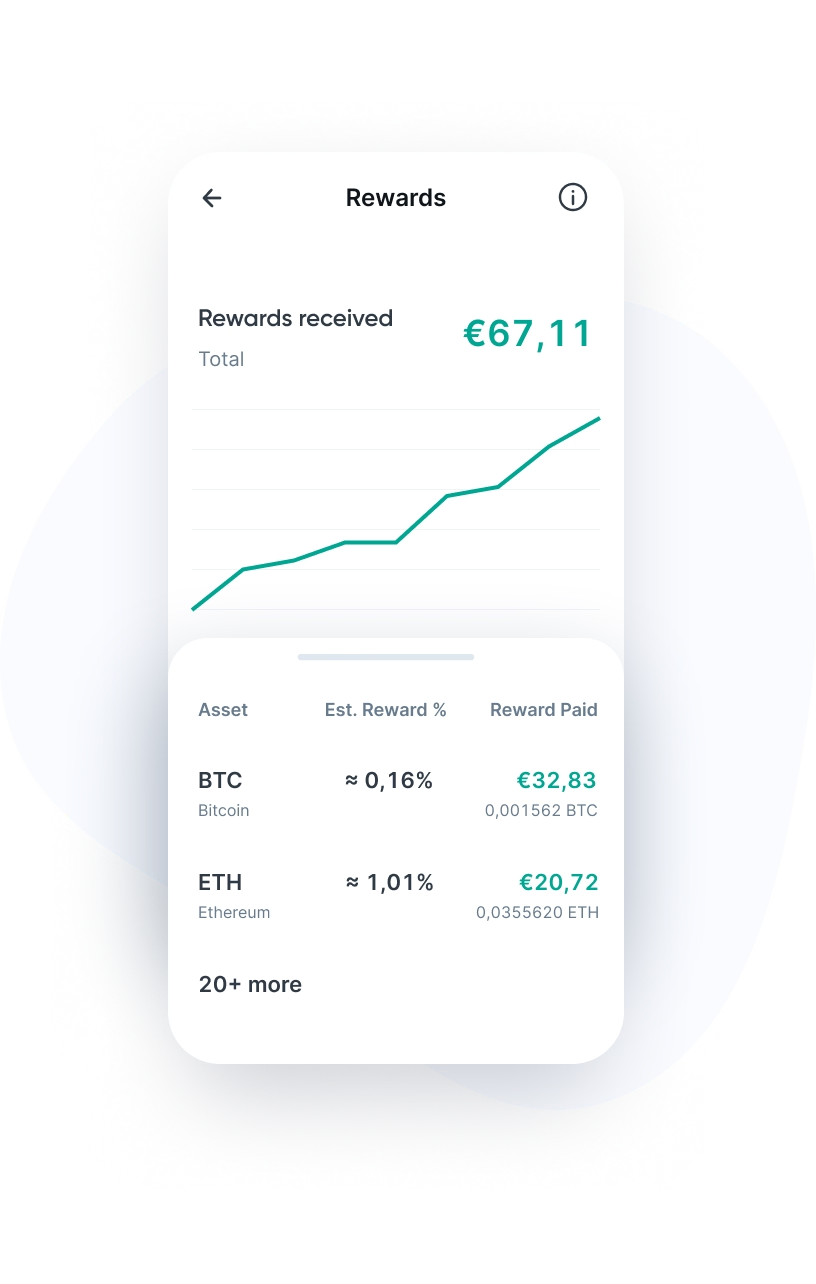

Staking Rewards

Bitvavo enables you to earn a return on your digital assets. Our staking service offers a yield of up to 15% on staked assets.

Frequently Asked Questions

Bitvavo makes GMX as easy as possible. Here are answers to common questions to help you make your first steps in the world of digital assets.

GMX is a DeFi platform for both beginner and advanced crypto traders. It is a decentralized exchange (DEX) for spot and perpetual trading. What sets GMX apart from other DeFi platforms is its ability to trade with leverage of up to 50x. This makes GMX attractive to experienced crypto traders, while its user-friendly interface and spot trading support attract beginners to the platform.

The platform focuses on ease of use, low transaction costs and zero-impact trading. This means that users can make large trades at market price without causing major price changes.

Liquidity on GMX comes from the GLP pool, which is an essential part of the platform. Liquidity providers are rewarded with GLP tokens. GMX is the main token on the platform and is used for governance and staking.

What is perpetual trading?

GMX offers perpetual trading. Perpetual trading is a popular form of crypto trading in which traders speculate on the future price of a cryptocurrency, similar to traditional futures contracts, but without an expiration date.

In perpetual trading, traders can open long positions (speculating on price increases) or short positions (speculating on price decreases). Traders can also use leverage, which allows them to take a larger position with a relatively small investment. This can increase potential profits, but also involves more risk.

Who founded GMX?

It is not clear who the founders of GMX are, but this is not unusual in the DeFi world. The project is managed by a team of anonymous developers and blockchain experts. This team works closely with the GMX community to further develop the platform.

The GMX platform offers various functions and possibilities. You can use GMX for:

- Spot trading: Users can trade various cryptocurrencies, including Ethereum and Bitcoin. To do so, users only need to connect their external wallet to the platform.

- Perpetual trading: On GMX, traders can trade perpetual contracts of different cryptocurrencies, similar to futures contracts with no expiration date.

- Providing liquidity: Users can add liquidity to the platform and earn rewards in the form of GLP tokens.

- Staking: By staking GMX tokens, users can participate in governance, contribute to the operation of the platform and receive rewards.

The GLP pool a multi-asset liquidity pool is at the core of GMX. This pool contains various assets, such as stablecoins (50-55%), Ethereum (25%), Bitcoin (20%) and other altcoins (5-10%). The pool is used for both spot and perpetual trading.

All tokens in the GLP pool are supplied by liquidity providers. They can mint (create) GLP tokens by lending tokens to the pool. These GLP tokens represent their share in the liquidity pool and can be exchanged for their loaned tokens at any time.

Chainlink Oracles and Arbitrum

GMX uses Chainlink oracles to obtain accurate price data for all assets in the liquidity pool. This accurate price data helps determine liquidations and thus protects users’ positions.

The platform launched on Arbitrum, a layer 2 scaling solution for Ethereum that offers higher transaction speeds and lower fees, making the platform cheaper and faster for users.

The GMX token plays an important role on the GMX platform. It is used as a governance token, meaning that token holders can vote on important decisions for the future of the platform.

GMX can also be used for staking, which allows users to earn rewards in the form of additional GMX tokens or other cryptocurrencies. Staking GMX contributes to the stability, operation, and security of the platform, while allowing stakers to earn passive income.

There is a maximum supply of 13.25 million GMX tokens. With this limited supply, the platform hopes to create scarcity around the GMX token, which is important for the value development of GMX.

The GLP token, short for GMX Liquidity Provider, is a reward for liquidity providers on the GMX platform. Users can mint GLP tokens by providing liquidity. The number of GLP tokens users receive is based on the amount of tokens deposited.

GLP token holders are entitled to a share of the trading fees generated on the platform. Unlike the GMX token, the GLP token cannot be traded. Users can "burn" their GLP tokens (remove them from circulation) to get their loaned tokens back. There is no maximum supply for GLP.

GMX distinguishes itself from other decentralized exchanges and DeFi platforms through several features:

- Spot and perpetual trading: GMX supports both spot and perpetual trading, giving traders more options in crypto investment.

- High leverages: Users can use leverages of up to 50x, setting GMX apart as a platform for experienced traders seeking higher risk and reward strategies.

- Multi-asset liquidity pool: GMX's unique multi-asset liquidity pool consists of a mix of stablecoins, Ethereum, Bitcoin and other altcoins, providing high liquidity and diverse trading options.

- User-friendly interface: GMX is known for its user-friendly interface, allowing both novice and advanced users to access DeFi products.

Users can trade popular cryptocurrencies such as Bitcoin and Ethereum or altcoins directly from their wallets on GMX. Spot trading, perpetual trading and high leverage are accessible to everyone.

Liquidity providers can add cryptocurrencies from their wallets to the multi-asset liquidity pool (called the GLP pool). As a reward, they receive GLP tokens. These tokens offer various benefits, including extras.

Users can stake GMX tokens by visiting the platform and clicking ‘Earn’. They can then connect their external wallet and stake GMX tokens directly for staking. The proceeds will be automatically distributed to the connected wallet.

GMX can be bought at Bitvavo. Our platform is accessible for both beginners and experienced investors. Follow the steps below to buy GMX via our website or app:

- Register or log in to your Bitvavo account.

- Add funds to your account using the "Deposit" option.

- Visit the GMX purchase page.

- Enter the amount in euros you wish to invest or the number of GMX coins you want to buy and confirm by clicking "Buy".

The price of GMX tokens depends on the current market value of GMX. After purchase, your GMX tokens will be immediately and automatically visible in your Bitvavo wallet, where you can easily manage or sell them. This allows you to respond quickly and effectively to market changes or price changes.

For optimal security, store your GMX in your Bitvavo account where the majority of customer cryptocurrencies are stored in secure, offline managed cold wallets. Enabling two-factor authentication (2FA) is highly recommended as an additional security measure for your account.

If you prefer to store your GMX tokens in a personal wallet, most software and hardware wallets support this type of coin. You can easily transfer GMX from Bitvavo to your own wallet by first adding the wallet address to your account.

* This is for informational purposes only and is not advice, nor should it be relied upon as such.

Direct Euro Transfers

Buying digital assets with Euros has never been easier. Bitvavo supports 8 payment methods, including SEPA for instant transfers.

Funding Methods →No Wallet Needed

Bitvavo manages your wallets and digital assets so you don't have to. Trade digital assets safely without technical knowledge.

Asset List →Security Features

Security is our top priority. Explore our security options and the measures we take to keep your account and our platform safe.

Our Security →Add GMX to your portfolio

Join over a million users buying and selling GMX at Bitvavo and enjoy our low fees and easy to use platform.

Sign up & Buy GMXBitvavo B.V.

Trading digital assets involves significant risks. Digital assets are highly volatile and you may lose some or all of your investment. The information on this page does not constitute advice, and should not be relied upon as such. Bitvavo is authorized as a crypto-asset service provider under Regulation (EU) 2023/1114 (MiCA) by the Autoriteit Financiële Markten (AFM), Vijzelgracht 50, 1017 HS Amsterdam. More info can be found in our Risk Disclosure.

Bitvavo is registered at the Dutch Chamber of Commerce, number 68743424.