Buy Enzyme

Buy Enzyme safely and easily at one of Europe's leading exchanges.

Low trading fees: 0.25%

Buy Enzyme with 8 payment methods

Enzyme wallet included

* Be aware that digital assets are highly volatile and investing in digital assets can lead to partial or total loss of your investment. Carefully assess your own situation, conduct your own research and only invest in digital assets with money you can lose. Past performance is no indication of future performance.

400+

1.5M+

100B+

4/5

Intuitive Mobile App

Download our mobile app to buy cryptocurrency instantly from your phone. Manage your digital assets from your phone anytime, anywhere.

Legal Compliance

Bitvavo is registered with De Nederlandsche Bank (DNB), the Dutch Chamber of Commerce, and complies with all relevant legislation.

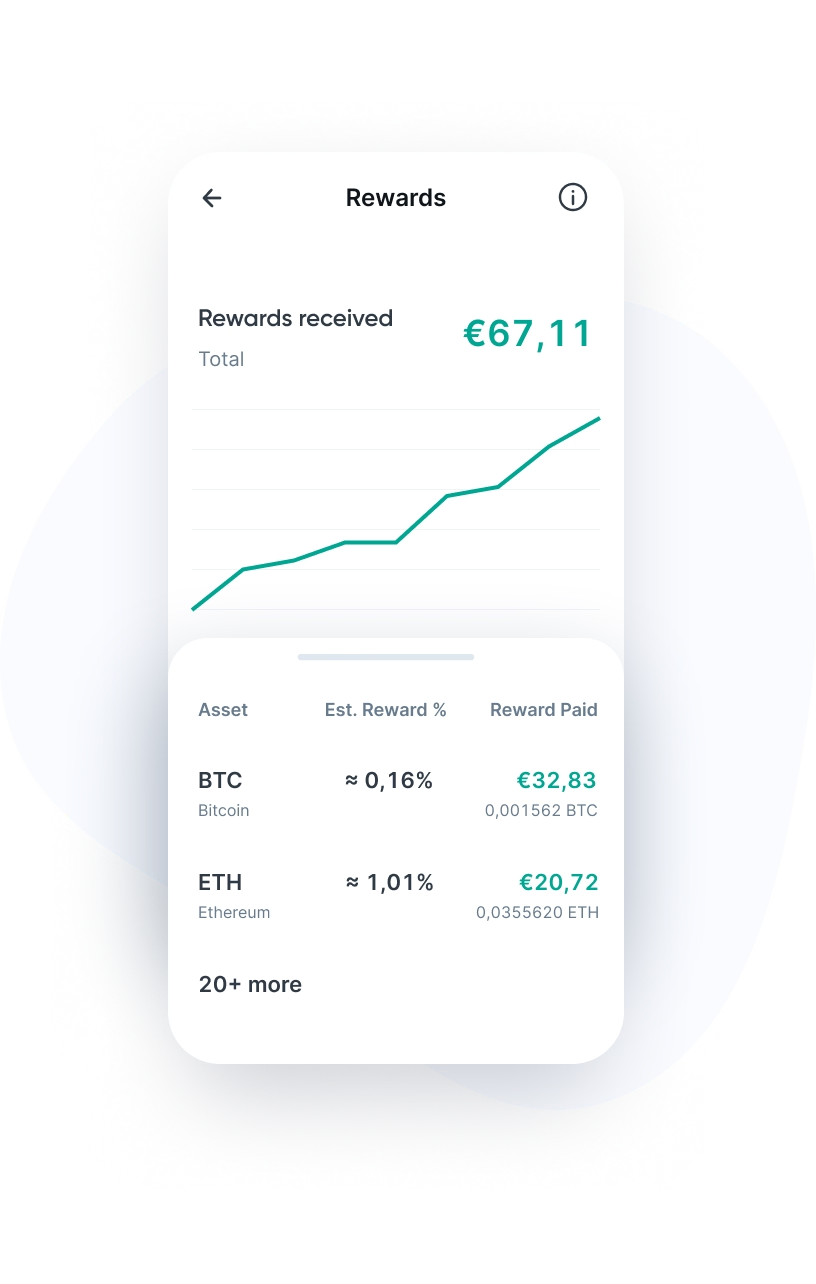

Staking Rewards

Bitvavo enables you to earn a return on your digital assets. Our staking service offers a yield of up to 15% on staked assets.

Frequently Asked Questions

Bitvavo makes Enzyme as easy as possible. Here are answers to common questions to help you make your first steps in the world of digital assets.

Enzyme Finance, formerly known as Melon Protocol, is an asset management platform built on the Ethereum blockchain. The platform enables both retail and institutional investors to access advanced financial tools in a decentralized manner. This makes asset management more accessible and affordable to a wider audience, including investors who would otherwise not have access to professional services.

Through Enzyme, users can manage their own funds, invest in other funds and even create automated investment strategies. This gives them the opportunity to invest and manage their portfolios without intermediaries, with full transparency thanks to the operation of smart contracts.

What makes Enzyme Finance unique is that it lowers the traditional barriers to wealth management. Traditionally, managed funds require significant investments, high fees and complex legal structures. Enzyme streamlines this process by harnessing the power of blockchain technology and smart contracts, making it easy for anyone to set up and manage a fund without third-party intervention.

The MLN token plays a central role in Enzyme’s ecosystem. It is used to execute transactions on the platform and acts as a governance token, allowing users to vote on policy changes within the protocol. This helps create a transparent and decentralized governance structure where the community owns the protocol.

The platform offers a user-friendly interface that is flexible and accessible for both beginners and experienced investors. Extensive tools allow users to manage their funds and portfolios, including performance metrics, risk management, and integration with various DeFi protocols.

Additionally, Enzyme leverages the benefits of DeFi (Decentralized Finance) by seamlessly integrating with prominent DeFi protocols such as Aave, Uniswap, and Compound. This gives users access to a wide range of financial products and services within a single platform, making Enzyme a powerful solution for anyone looking to leverage the potential of DeFi.

Who founded Enzyme?

Enzyme Finance was founded in 2016 by Mona El Isa, a former Vice President at Goldman Sachs, and mathematician Rito Trinkler. Both founders have a strong background in traditional finance and deep knowledge of blockchain technology. Mona El Isa founded Enzyme with the mission to make the financial markets more accessible and transparent for everyone, regardless of their financial situation.

In 2019, control of Enzyme was transferred to the Melon Council, a decentralized autonomous organization (DAO). This governance model places the development and management of the protocol in the hands of the community rather than a centralized entity. Melon Council members can invite new members and deploy protocol updates via smart contracts.

Enzyme Finance offers a variety of features and applications for both individual users and developers. Here are some key use cases:

- Customized investment strategies: Users can set up their own fund based on their specific investment strategy and fully automate this strategy.

- Asset management: The platform allows users to manage their own investment fund or invest in the fund of others, all without intermediaries.

- Decentralized Finance (DeFi): Through integration with leading DeFi protocols such as Aave and Uniswap, users can explore and leverage a wide range of financial products and services.

- Transparent management: Investors can trust that their funds are managed according to pre-defined smart contracts, without relying on a human fund manager.

- Development incentives: Developers can contribute to improving the Enzyme Protocol by finding bugs or developing new features, for which they are financially rewarded.

Enzyme Finance is a collection of smart contracts running on the Ethereum blockchain and is designed with two main layers: the Fund layer and the Infrastructure layer.

The Fund layer

The Fund layer is the heart of Enzyme, where users create and manage their funds. This is where the interaction with the blockchain takes place, and users can set up their own fund or invest in funds from others. This layer consists of two crucial components: the Hub and the Spokes.

Hub: This is the central hub of the Fund layer. It acts as the management interface where all the tools and functions needed to create a fund are managed. The Hub provides an overview of the assets and keeps track of all transactions that take place within the fund.

Spokes: The Spokes are specific smart contracts that are responsible for various parts of fund management, such as asset storage (vault) and share distribution (ownership rights within the fund).

The Infrastructure layer

The Infrastructure layer supports the operation of the Enzyme platform and includes all contracts and systems needed to keep the protocol running smoothly. This layer is managed by the Melon Council and ensures that the rules and processes within Enzyme are executed correctly.

- Adapter contract: This contract links assets to price feeds, essential for establishing trading values.

- Engine contract: This contract manages the conversion of ETH to MLN and is used for transactions and calculations within the protocol.

- Price source contract: This contract provides current asset pricing information, which is used in managing funds.

Governance and decentralization

A key feature of Enzyme is its decentralized governance via the Melon Council. Users can stake their MLN tokens to vote on important policy changes within the protocol. This gives the community direct control over the future of Enzyme, which is essential to the decentralized nature of the platform.

The MLN token plays a crucial role within the Enzyme Protocol and is used for various functions, such as executing transactions and paying management and performance fees within funds. MLN also acts as a governance token, allowing holders to vote on important decisions within the Melon Council, the DAO that governs the protocol.

The total supply of MLN tokens is volatile as the protocol creates 300,600 new tokens annually to support the development and maintenance of the network. At the same time, a mechanism for burning tokens is built in, which limits the circulating supply. This occurs when The DAO converts ETH to MLN and then removes these tokens from circulation. This deflationary mechanism could increase the scarcity of MLN tokens in the long term, potentially putting upward pressure on the price.

Staking MLN gives users the opportunity to actively participate in the governance of the Enzyme Finance protocol. By staking their MLN tokens, holders can vote on important proposals such as protocol updates and policy changes. This strengthens the decentralized structure of the project and ensures that the community has a direct influence on the governance and development of Enzyme.

Staking is done through the Melon Council DAO, where staked tokens are used to support or reject proposals. Users who stake their tokens are incentivized to remain actively involved, as they can participate in a reward system that compensates them for their efforts in the governance of the protocol.

Enzyme stands out due to a number of unique features that make it a powerful platform within the world of decentralized asset management:

- Decentralized asset management: Enzyme enables users to manage funds without the intervention of traditional parties. This democratizes asset management and makes it accessible to a wider audience.

- Smart contracts for transparency: All funds on Enzyme are managed via smart contracts, ensuring full transparency and trust. This allows users to be sure that their investments are managed according to pre-defined rules.

- Advanced DeFi integrations: By integrating with leading DeFi protocols like Aave, Uniswap, and Compound, users gain access to a wide range of financial services on a single platform.

- Community-driven governance: Through the Melon Council DAO, users have direct influence on decision-making within the protocol. This strengthens decentralization and gives the community power over Enzyme’s future.

- Scarcity through burning mechanism: The protocol periodically burns a portion of the MLN tokens, which reduces the circulating supply and creates potential upward pressure on the token's value.

At Bitvavo you can buy Enzyme Finance (MLN). Our platform is suitable for both novice and experienced traders. Follow these steps to buy MLN via our website or app:

- Register or log in to your Bitvavo account.

- Add funds by clicking "Deposit".

- Go to the Enzyme Finance (MLN) purchase page.

- Enter the amount in euros you want to invest or select the number of MLN tokens you want to purchase and click "Buy".

The price of MLN depends on the current market value. After purchase, the tokens are immediately added to your Bitvavo account, so you can easily manage and sell them.

Your MLN tokens can be safely stored in your Bitvavo account, with the majority of customer funds being kept in offline cold storage for optimal security. To further protect your account, you can also enable two-factor authentication (2FA). This means that in addition to your password, a unique code is also required when logging in.

If you prefer to transfer your MLN tokens to an external wallet, you can easily do this via your Bitvavo account. First, make sure to verify the wallet address before executing the transaction. After that, you can seamlessly transfer your tokens to a software or hardware wallet of your choice.

* This is for informational purposes only and is not advice, nor should it be relied upon as such.

Direct Euro Transfers

Buying digital assets with Euros has never been easier. Bitvavo supports 8 payment methods, including SEPA for instant transfers.

Funding Methods →No Wallet Needed

Bitvavo manages your wallets and digital assets so you don't have to. Trade digital assets safely without technical knowledge.

Asset List →Security Features

Security is our top priority. Explore our security options and the measures we take to keep your account and our platform safe.

Our Security →Add Enzyme to your portfolio

Join over a million users buying and selling Enzyme at Bitvavo and enjoy our low fees and easy to use platform.

Sign up & Buy EnzymeBitvavo B.V.

Trading digital assets involves significant risks. Digital assets are highly volatile and you may lose some or all of your investment. The information on this page does not constitute advice, and should not be relied upon as such. Bitvavo is authorized as a crypto-asset service provider under Regulation (EU) 2023/1114 (MiCA) by the Autoriteit Financiële Markten (AFM), Vijzelgracht 50, 1017 HS Amsterdam. More info can be found in our Risk Disclosure.

Bitvavo is registered at the Dutch Chamber of Commerce, number 68743424.