Buy Convex Finance

Buy Convex Finance safely and easily at one of Europe's leading exchanges.

Low trading fees: 0.25%

Buy Convex Finance with 8 payment methods

Convex Finance wallet included

* Be aware that digital assets are highly volatile and investing in digital assets can lead to partial or total loss of your investment. Carefully assess your own situation, conduct your own research and only invest in digital assets with money you can lose. Past performance is no indication of future performance.

400+

1.5M+

100B+

4/5

Intuitive Mobile App

Download our mobile app to buy cryptocurrency instantly from your phone. Manage your digital assets from your phone anytime, anywhere.

Legal Compliance

Bitvavo is registered with De Nederlandsche Bank (DNB), the Dutch Chamber of Commerce, and complies with all relevant legislation.

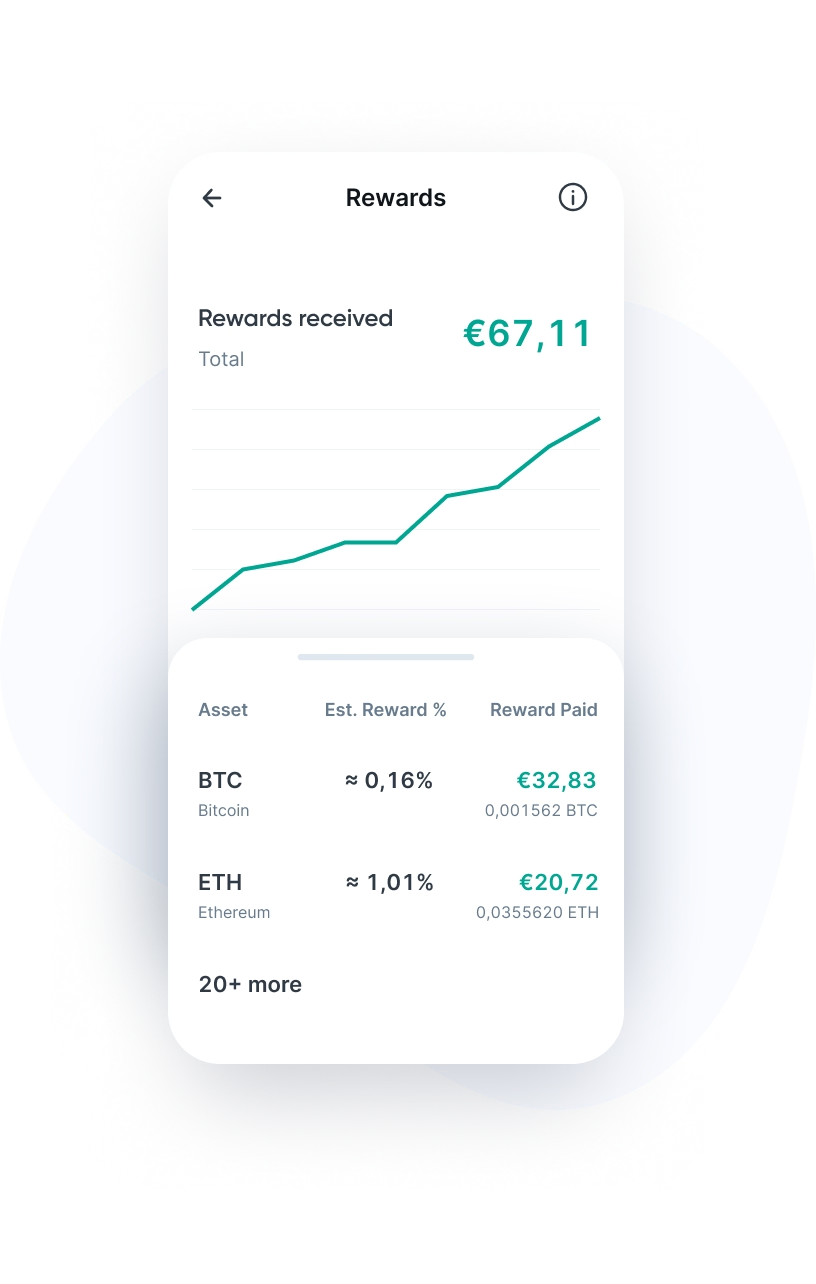

Staking Rewards

Bitvavo enables you to earn a return on your digital assets. Our staking service offers a yield of up to 15% on staked assets.

Frequently Asked Questions

Bitvavo makes Convex Finance as easy as possible. Here are answers to common questions to help you make your first steps in the world of digital assets.

Convex Finance is a DeFi protocol designed to maximize yields for users on Curve Finance. Curve Finance is a decentralized exchange (DEX) and liquidity pool on Ethereum, primarily focused on exchanging stablecoins. Convex offers users the ability to stake their Curve-based tokens for increased rewards and easier access to yield farming.

Without Convex Finance, users are left to figure out the best strategies to maximize their rewards on their own, which is often a time-consuming and complicated task. Convex simplifies this process by allowing users to deposit their tokens onto the platform, after which Convex manages the tokens and automatically places them into the best pools to receive the highest rewards.

Users can stake various tokens on Convex Finance, such as CRV and LP tokens. Users can also participate in governance via veCRV tokens and stake their cvxCRV tokens to earn additional rewards.

The CVX token is Convex Finance’s native token and plays a central role in the ecosystem. It is issued to users who stake Curve’s CRV and LP tokens. CVX tokens can also be staked to earn a share of platform revenues. In addition, CVX token holders can vote on important decisions within the protocol.

Who founded Convex Finance?

Convex Finance was founded by a pseudonymous individual or group known as C2tP. The identity of this founder(s) remains unknown to this day, similar to Bitcoin’s Satoshi Nakamoto. The project is currently managed by a group of developers and users, though the exact size of the team is unknown.

Convex Finance has several features and use cases:

- Staking CRV tokens: Users can stake their CRV tokens on Convex Finance to earn cvxCRV tokens, which give access to higher rewards.

- Staking of LP tokens: Liquidity providers can stake their LP tokens to receive additional CVX and CRV rewards without locking their tokens.

- Yield farming: Users can benefit from higher returns by participating in Convex's optimized yield farming strategies.

- Governance: CVX token holders can vote on changes and additions to the protocol, as well as the allocation of veCRV reserves.

Convex Finance allows users to deposit their Curve tokens on the platform. Convex then manages these tokens and generates higher rewards by using its collective bargaining power.

Curve and veCRV

Curve Finance uses CRV tokens to reward liquidity providers (LPs). These CRV tokens can be locked to generate veCRV tokens. VeCRV tokens give users voting rights within Curve and increase their rewards. Convex collects large amounts of veCRV by collectively staking users’ CRV tokens. This gives Convex significant influence over the governance of Curve and allows Convex to optimize rewards and liquidity on the Curve platform, resulting in higher returns for all Convex users.

Stakes on Convex

Users can stake their CRV tokens on Convex and receive cvxCRV tokens in return. These tokens represent their stake on Convex and give them access to enhanced rewards and voting rights. Additionally, users can stake their LP tokens to earn additional CRV and CVX rewards without locking their tokens.

The role of the CVX token

The CVX token is issued to users who stake their tokens on Convex. CVX itself can also be staked to earn a share of platform revenues and to gain voting rights within the Convex protocol. Token holders can then vote on changes or additions, as well as on the allocation of veCRV reserves.

While Convex Finance allows for higher rewards through staking and yield farming, it's important to remember that staking on DeFi platforms is always risky. Everything is automated through smart contracts and there are no intermediaries to help if something goes wrong. Users always run the risk of losing their stake.

The CVX token plays a crucial role in the Convex Finance ecosystem. Its main function is to reward users who stake their Curve tokens on the Convex platform. Users receive CVX tokens as compensation for staking their CRV and LP tokens. In addition, CVX can be staked to receive a share of the revenues of the Convex platform.

CVX is also used for governance within the Convex ecosystem. CVX holders can lock their tokens to generate vlCVX (vote-locked CVX), which gives them voting rights on important decisions within the protocol. This allows users to influence the allocation of veCRV reserves and other governance-related issues.

The maximum supply of CVX tokens is 100 million. 50% of this is reserved for rewarding users who stake their tokens on the platform. The remaining 50% is divided among various purposes, including 25% for liquidity mining, 10% for the development team, 9.7% for the Convex Treasury, 3.3% for investors, and 2% for airdrops to veCRV token holders.

Staking CVX on Convex Finance is easy and offers users additional rewards. Follow these steps to stake CVX:

- Connect your wallet: Go to the Convex Finance website and connect your wallet to the platform.

- Deposit CVX Tokens: Head to the staking section and select the option to stake CVX tokens. Enter the amount of CVX tokens you want to stake and confirm the transaction.

- Earn rewards: Once your CVX tokens are staked, you will automatically start earning rewards. These rewards can include a share of platform revenue and additional CVX tokens.

Convex Finance has become a unique and distinctive platform in several ways:

- Easy staking: The platform makes staking easier, giving users access to higher rewards and yield farming strategies without much effort.

- Easy-to-use platform: Convex simplifies yield farming and liquidity provision, often seen as difficult and complex, allowing both beginners and experts to benefit.

- Collective bargaining power: Convex Finance aggregates large amounts of veCRV, giving it significant influence over Curve’s governance and reward systems, resulting in higher returns for all users.

- Double rewards: Users who stake their CRV and LP tokens will receive both CVX and CRV rewards, providing more attractive returns.

- Reward optimization: Convex optimizes rewards for liquidity provision and staking, leading to higher returns than staking on Curve alone.

Convex Finance vs. Curve Finance

Convex Finance and Curve Finance both use CRV tokens; Curve rewards its users for providing liquidity, while Convex optimizes these rewards. Both platforms operate on the Ethereum blockchain and are therefore accessible to anyone with an Ethereum wallet.

While there are similarities, there are also key differences. Curve Finance is primarily a decentralized exchange (DEX) focused on exchanging stablecoins and other tokens via liquidity pools. Convex Finance, on the other hand, acts as a yield optimizer that maximizes rewards for Curve users. While Curve focuses on efficient trading, Convex offers a simplified way to earn higher returns by staking and managing CRV tokens. Additionally, Convex pools large amounts of veCRV tokens for collective bargaining power, something Curve itself does not do.

You can purchase Convex Finance (CVX) at Bitvavo. Our platform is accessible to novice and experienced traders alike. Follow these steps to buy CVX tokens via our website and app:

- Log in to your Bitvavo account or create a new account.

- Add funds to your account by clicking "Deposit".

- Go to the Convex Finance (CVX) purchase page.

- Enter the amount in euros you wish to spend or the number of CVX tokens you want to purchase and click "Buy".

The current market value determines how expensive the CVX tokens are. After purchase, your CVX tokens are automatically added to your Bitvavo account, where you can easily manage and trade them. Selling CVX tokens is just as easy, allowing you to quickly respond to market and price changes.

You can safely store your CVX tokens within your Bitvavo account. Bitvavo keeps the majority of assets in cold storage, which is managed offline. We recommend enabling two-factor authentication (2FA) as an additional layer of security for your account.

It's also possible to manage your CVX tokens yourself. Most software and hardware wallets support CVX. After purchase, you can easily transfer tokens to an external wallet by linking the wallet address to your Bitvavo account. This gives you full control over your cryptocurrencies.

* This is for informational purposes only and is not advice, nor should it be relied upon as such.

Direct Euro Transfers

Buying digital assets with Euros has never been easier. Bitvavo supports 8 payment methods, including SEPA for instant transfers.

Funding Methods →No Wallet Needed

Bitvavo manages your wallets and digital assets so you don't have to. Trade digital assets safely without technical knowledge.

Asset List →Security Features

Security is our top priority. Explore our security options and the measures we take to keep your account and our platform safe.

Our Security →Add Convex Finance to your portfolio

Join over a million users buying and selling Convex Finance at Bitvavo and enjoy our low fees and easy to use platform.

Sign up & Buy Convex FinanceBitvavo B.V.

Trading digital assets involves significant risks. Digital assets are highly volatile and you may lose some or all of your investment. The information on this page does not constitute advice, and should not be relied upon as such. Bitvavo is authorized as a crypto-asset service provider under Regulation (EU) 2023/1114 (MiCA) by the Autoriteit Financiële Markten (AFM), Vijzelgracht 50, 1017 HS Amsterdam. More info can be found in our Risk Disclosure.

Bitvavo is registered at the Dutch Chamber of Commerce, number 68743424.