Buy Blur

Buy Blur safely and easily at one of Europe's leading exchanges.

Low trading fees: 0.25%

Buy Blur with 8 payment methods

Blur wallet included

* Be aware that digital assets are highly volatile and investing in digital assets can lead to partial or total loss of your investment. Carefully assess your own situation, conduct your own research and only invest in digital assets with money you can lose. Past performance is no indication of future performance.

400+

1.5M+

100B+

4/5

Intuitive Mobile App

Download our mobile app to buy cryptocurrency instantly from your phone. Manage your digital assets from your phone anytime, anywhere.

Legal Compliance

Bitvavo is registered with De Nederlandsche Bank (DNB), the Dutch Chamber of Commerce, and complies with all relevant legislation.

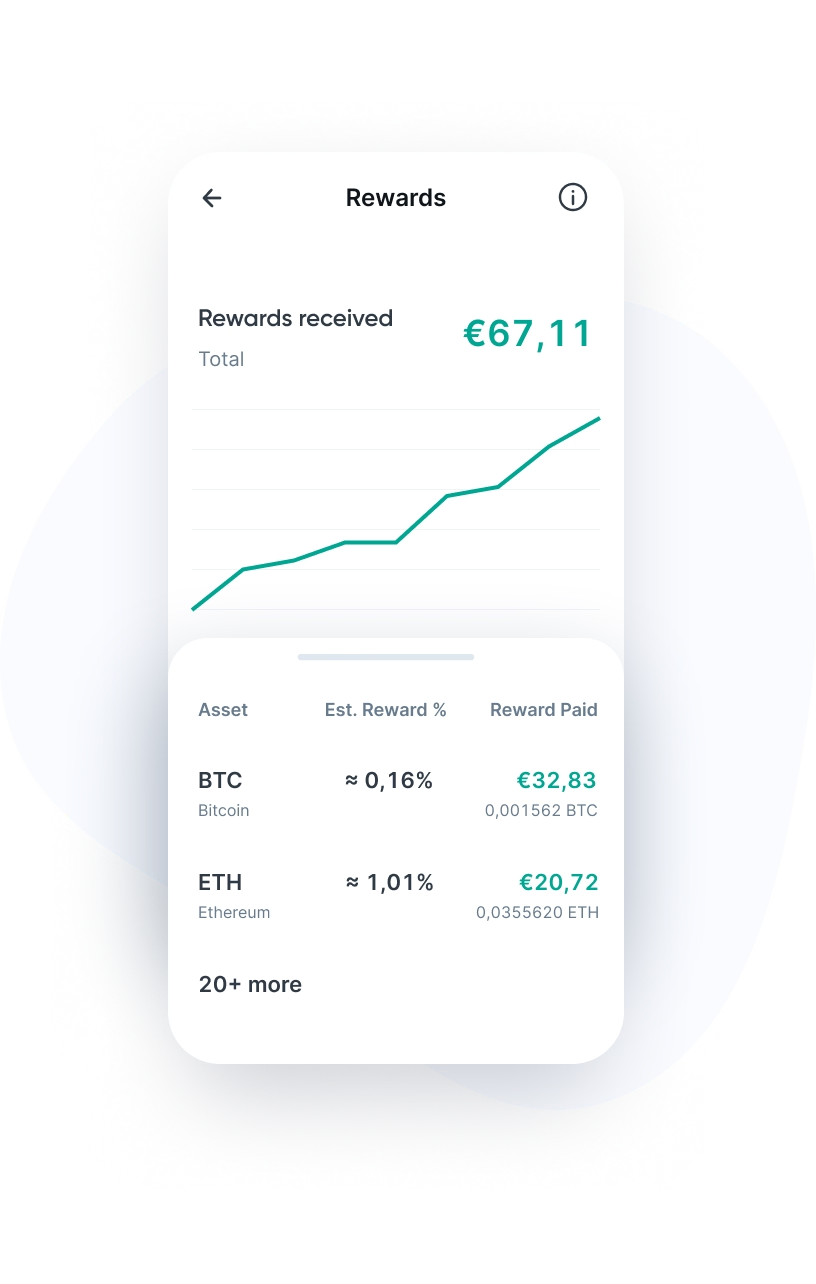

Staking Rewards

Bitvavo enables you to earn a return on your digital assets. Our staking service offers a yield of up to 15% on staked assets.

Frequently Asked Questions

Bitvavo makes Blur as easy as possible. Here are answers to common questions to help you make your first steps in the world of digital assets.

Blur (BLUR) is a decentralized non-fungible token (NFT) marketplace aimed at professional traders with a wide range of advanced features. What sets Blur apart from other NFT marketplaces like OpenSea is its lack of transaction fees and the ability to use NFTs as collateral for loans. This unique combination makes Blur attractive to both traders looking to make fast, fee-free transactions and users looking to capture the value of their NFTs without selling them.

Since its launch in October 2022, Blur has seen explosive growth, with the platform processing more than three-quarters of all NFT transactions worldwide by January 2024. This growth has been fueled by advanced tools tailored specifically to experienced traders, such as detailed market analysis and the ability to buy multiple NFTs in a single transaction, known as “floor sweeping.”

One of Blur’s most notable features is its integration with a peer-to-peer lending protocol called Blend (Blur Lending). Blend allows users to pledge their NFTs as collateral for loans without an expiration date attached to the loan. This provides traders with access to liquidity while retaining their valuable NFTs. The system works by establishing a loan agreement between the borrower and the lender, placing the NFT in a secure vault until the loan is repaid.

Blur is governed by a Decentralized Autonomous Organization (DAO) and uses the BLUR token for governance. Holders of this Ethereum-based token can vote on proposals that determine the direction of the platform. BLUR’s tokenomics are designed such that the majority of tokens (51%) are allocated to the community, encouraging active participation. The remaining tokens are distributed among developers, investors, and advisors.

Who founded Blur?

Blur was founded by Tieshun Roquerre, also known as Pacman, and Anthony Liu, who goes by the online name Galaga. The two founders met while studying at the Massachusetts Institute of Technology (MIT). Roquerre has a background in the crypto industry as the founder of Namebase, a crypto domain name company, which he later sold. The current Blur team consists of a diverse group of developers and marketing specialists who contribute to the platform’s continued growth and innovation.

Blur offers a wide range of features that appeal to both end users and developers:

- Trading NFTs without transaction fees: Users can buy and sell NFTs without fees, contributing to more profitable trading.

- NFTs as collateral for loans: Traders can use their NFTs as collateral to obtain loans, giving them access to liquidity without having to sell their assets.

- Advanced trading features: Blur offers tools like detailed market analysis and “floor sweeping,” which allows traders to buy multiple NFTs at once for an optimal price.

- Community governance via BLUR token: Holders of the BLUR token can participate in decision-making about the future of the platform by voting on proposals within The DAO.

- Airdrops and rewards: Active users can receive rewards in the form of BLUR tokens, making them more engaged with the platform.

Blur runs on the Ethereum blockchain, providing an easy-to-use platform where traders can easily connect their Ethereum wallets to buy and sell NFTs. Users can start trading immediately, without the need for a central party.

A key aspect of Blur is the use of smart contracts to execute transactions. These contracts automate the buying and selling process, allowing the platform to function without human intervention.

The Blend lending protocol

Blend, Blur’s lending protocol, allows users to use NFTs as collateral for loans. The protocol operates peer-to-peer, meaning there is no central party determining the terms of the loan. Instead, borrowers and lenders can negotiate terms, such as interest rates and collateral, directly with each other.

The lending process begins when a borrower offers an NFT as collateral and submits a loan request. A lender can accept these terms, at which point the NFT is placed in a smart contract that acts as a vault. This vault is designed to securely hold the NFT until the loan is repaid or the lender decides to terminate the contract. This is done via a so-called “Dutch auction,” where the interest rate gradually increases until a new lender takes over the contract or the borrower repays the loan.

Technical foundation and safety

Blur uses the Ethereum blockchain, which means the platform benefits from its strong security measures and decentralized nature. All transactions on the platform are recorded on the blockchain, ensuring transparency and traceability. In addition, Blur uses smart contracts to automate all processes, from trading NFTs to managing loans via Blend.

The integration of wallets such as Blur Wallet and Atomic Wallet provides users with additional security and control over their crypto assets. Users can securely manage and store their NFTs and BLUR tokens, knowing that their assets are protected from unauthorized access.

The BLUR token is the native token of the Blur marketplace and plays a crucial role in both the governance of the platform and the rewarding of active users. BLUR tokens are primarily used to participate in Blur’s Decentralized Autonomous Organization (DAO). Holders of BLUR tokens have voting rights that allow them to decide on proposals that determine the future of the platform, such as changes to the fee structure or the introduction of new features. In addition, BLUR tokens are also used as rewards for users who actively trade on the platform.

The total maximum supply of BLUR tokens is set at 3 billion, of which 51% is allocated to the community. These tokens are distributed through airdrops and other rewards programs. The remaining tokens are distributed to Blur’s developers, investors, and advisors, with a vesting period that runs until February 2027. This ensures the stability of the BLUR token by preventing these tokens from being traded prematurely.

BLUR tokens can be staked to participate in the governance of the Blur marketplace and earn rewards. Staking involves locking up your BLUR tokens on the platform for a set period of time, which gives you voting rights within The DAO. The more tokens you stake, the greater your influence on decision-making. Staking BLUR is simple: connect your Ethereum wallet to the Blur platform, select the amount of BLUR tokens you want to stake, and confirm the transaction.

In exchange for staking BLUR tokens, you receive rewards in the form of additional BLUR tokens, depending on the amount and duration of your stake. This makes staking an attractive option for users who want to contribute to the development of the platform and at the same time increase their crypto holdings.

Blur stands out for its innovative approach to the NFT marketplace, offering features that make the platform unique in the crypto world:

- Focus on professional traders: Blur is specifically designed for experienced NFT traders, with advanced tools and analytics that are far more detailed than other platforms.

- Completely fee-free trading: While other platforms charge transaction fees, Blur offers completely free NFT trading. This lowers the barrier for active traders and enables higher profits.

- Unique combination of marketplace and lending platform: Blur combines an advanced NFT marketplace with the Blend protocol, allowing users to use their NFTs as collateral for loans.

- DAO-driven governance: Blur is governed by a decentralized community of BLUR token holders, giving users direct influence on the development and direction of the platform.

- High liquidity and fast swaps: Blur offers deep liquidity and fast swaps, allowing traders to quickly respond to market movements without lengthy processing or transaction times.

You can purchase Blur on the Bitvavo platform (BLUR). Our platform is suitable for both new and experienced traders. Follow these steps to buy BLUR via our website or mobile app:

- Sign up or log in to your Bitvavo account.

- Make a deposit by clicking "Deposit".

- Go to the Blur (BLUR) purchase page.

- Enter the amount in euros you want to invest, or the number of BLUR tokens you wish to purchase, then click "Buy".

The price of BLUR tokens is updated in real time, so you can always buy at the most current rate. After purchase, your BLUR tokens are automatically added to your Bitvavo account, where you can easily manage and trade them. This way you can quickly respond to changes in the market.

Want to store your Blur tokens securely? You can easily do so in your Bitvavo account. Bitvavo stores the majority of customer funds in secure offline storage, also known as cold storage. Although the security is very advanced, we recommend enabling two-factor authentication (2FA) for extra protection. This means that in addition to your password, you will also have to enter an additional verification code when logging in.

Additionally, you can choose to store your Blur tokens in external software or hardware wallets. If you decide to move your BLUR tokens to an external wallet, always check the wallet address in your Bitvavo account before executing the transaction. This way, you can safely and quickly transfer your tokens to an external wallet of your choice.

* This is for informational purposes only and is not advice, nor should it be relied upon as such.

Direct Euro Transfers

Buying digital assets with Euros has never been easier. Bitvavo supports 8 payment methods, including SEPA for instant transfers.

Funding Methods →No Wallet Needed

Bitvavo manages your wallets and digital assets so you don't have to. Trade digital assets safely without technical knowledge.

Asset List →Security Features

Security is our top priority. Explore our security options and the measures we take to keep your account and our platform safe.

Our Security →Add Blur to your portfolio

Join over a million users buying and selling Blur at Bitvavo and enjoy our low fees and easy to use platform.

Sign up & Buy BlurBitvavo B.V.

Trading digital assets involves significant risks. Digital assets are highly volatile and you may lose some or all of your investment. The information on this page does not constitute advice, and should not be relied upon as such. Bitvavo is authorized as a crypto-asset service provider under Regulation (EU) 2023/1114 (MiCA) by the Autoriteit Financiële Markten (AFM), Vijzelgracht 50, 1017 HS Amsterdam. More info can be found in our Risk Disclosure.

Bitvavo is registered at the Dutch Chamber of Commerce, number 68743424.