Buy Bitcoin Cash

Buy Bitcoin Cash safely and easily at one of Europe's leading exchanges.

Low trading fees: 0.25%

Buy Bitcoin Cash with 8 payment methods

Bitcoin Cash wallet included

* Be aware that digital assets are highly volatile and investing in digital assets can lead to partial or total loss of your investment. Carefully assess your own situation, conduct your own research and only invest in digital assets with money you can lose. Past performance is no indication of future performance.

400+

1.5M+

100B+

4/5

Intuitive Mobile App

Download our mobile app to buy cryptocurrency instantly from your phone. Manage your digital assets from your phone anytime, anywhere.

Legal Compliance

Bitvavo is registered with De Nederlandsche Bank (DNB), the Dutch Chamber of Commerce, and complies with all relevant legislation.

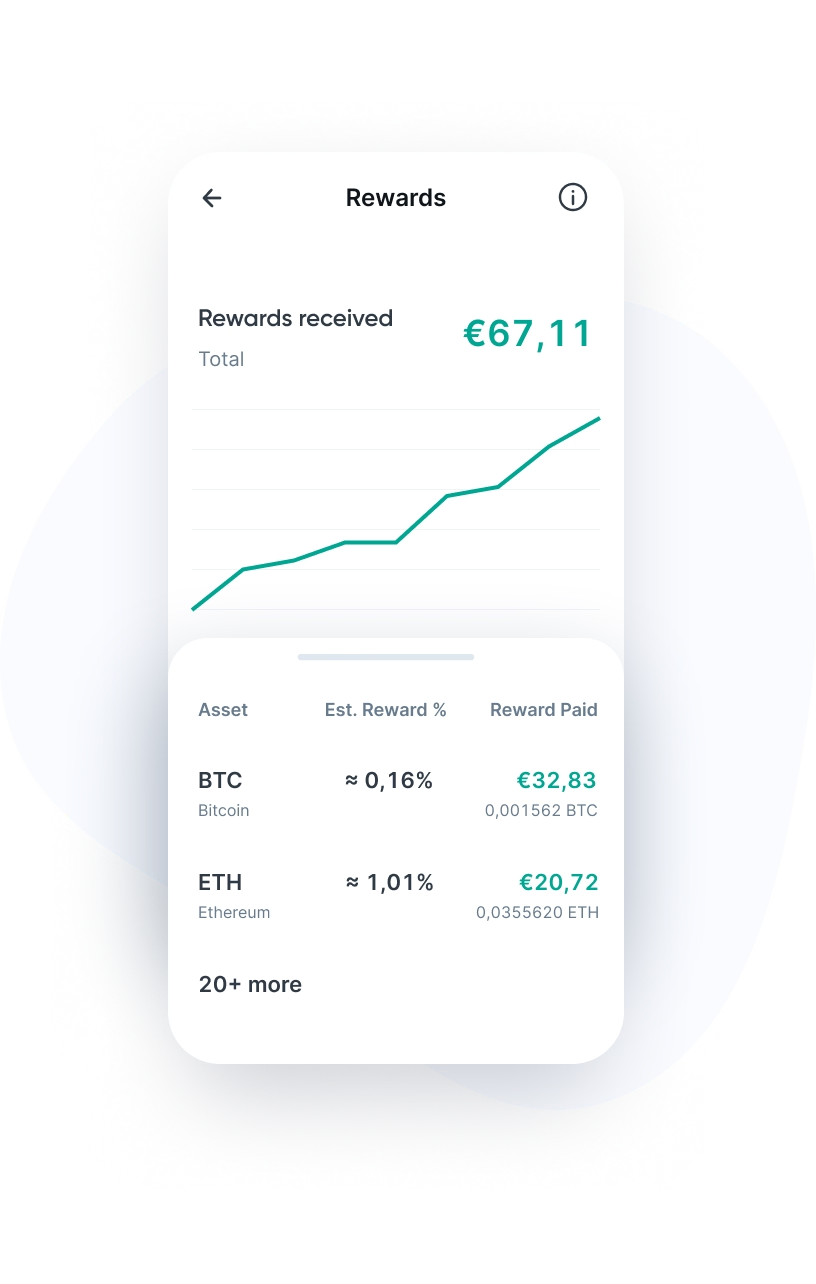

Staking Rewards

Bitvavo enables you to earn a return on your digital assets. Our staking service offers a yield of up to 15% on staked assets.

Frequently Asked Questions

Bitvavo makes Bitcoin Cash as easy as possible. Here are answers to common questions to help you make your first steps in the world of digital assets.

Bitcoin Cash (BCH) is a cryptocurrency that emerged in 2017 as a hard fork of Bitcoin. The goal of Bitcoin Cash was to address Bitcoin's scalability issues and enable faster, cheaper transactions. Unlike Bitcoin, which has a block size limit of 1 MB, Bitcoin Cash chose to increase its block size to 8 MB. It was later increased again to 32 MB. This allows Bitcoin Cash to process more transactions per block and offer lower transaction fees.

In addition to solving scalability issues, Bitcoin Cash also aims to be a globally accepted peer-to-peer electronic cash. It builds on the same principles as Bitcoin, such as decentralization, security, and privacy. Users can send BCH directly to each other without having to rely on banks or other financial institutions. This makes cross-border payments easier, faster, and potentially cheaper.

Another notable feature of Bitcoin Cash is its support for smart contracts. Developers can create smart contracts themselves and build decentralized applications (dApps) on the network.

Who Created Bitcoin Cash (BCH)?

Bitcoin Cash was founded in August 2017 by a group of developers and miners who were unhappy with Bitcoin’s scalability plans. This group, known as the Bitcoin ABC developers, led the fork and implemented the increased block size.

Bitcoin Cash is currently managed by a decentralized community of developers around the world. There is no central authority that controls Bitcoin Cash. The development team works together to propose and implement improvements to the protocol.

A hard fork is a split in the blockchain that creates a new version with different rules to the original blockchain. This happened to Bitcoin on August 1, 2017, resulting in Bitcoin Cash.

The reason behind this split lay in different views within the crypto community regarding the future development of Bitcoin. Some wanted to stick to limiting the block size to maintain decentralization, while others believed that an increased block size was needed to solve scalability issues.

The split resulted in two separate blockchains: Bitcoin and Bitcoin Cash. Each blockchain has its own currency (BTC for Bitcoin and BCH for Bitcoin Cash) and follows its own rules regarding block size, transaction fees, and consensus mechanisms.

Bitcoin Cash can be used for various purposes, including:

- Microtransactions: Bitcoin Cash is ideal for making small payments thanks to its faster block times and lower transaction fees. It allows you to pay for goods and services both online and offline.

- International payments: Bitcoin Cash enables quick cross-border money transfers without third party intervention. This makes it convenient for people who need to make international payments on a regular basis.

- Investing: As a volatile cryptocurrency, Bitcoin Cash can also serve as an investment vehicle. Users can buy and sell BCH on crypto exchanges like Bitvavo and potentially profit from price fluctuations.

- Smart contracts: Developers can create smart contracts and launch decentralized applications and protocols on Bitcoin Cash.

Bitcoin Cash uses a blockchain similar to Bitcoin. Each transaction is recorded by miners in a block, which is then added to the chain of previous blocks. Other miners in the network confirm these blocks, which creates a consensus on the validity of the transactions.

Consensus is achieved through the Proof-of-Work (PoW) consensus mechanism, where miners must use computing power to validate transactions and generate new blocks. Miners compete to perform complex calculations, and the first to succeed gets to add the next block to the blockchain. That miner then receives a reward in BCH.

Bitcoin Cash network security

Bitcoin Cash security is based on the decentralization of the network and the cryptographic security of the blockchain. Transactions and blocks are protected using hash functions such as SHA-256, which ensure that only the owner of a Bitcoin Cash address can make transactions.

Smart contracts

Unlike Bitcoin, Bitcoin Cash supports smart contracts and decentralized applications (dApps). Several applications are built on the Bitcoin Cash network, such as CashShuffle and CashFusion. CashShuffle allows transactions from different users to be mixed, making it harder to trace transaction history. CashFusion takes this a step further by combining and mixing transactions, resulting in a higher level of privacy.

Mining Bitcoin Cash is a similar process to mining Bitcoin. Miners use their computing power to perform calculations needed to verify transactions and add new blocks to the blockchain. As a reward, miners receive BCH coins.

In order to mine BCH, you will need special mining hardware, such as ASIC miners that are specifically designed for mining cryptocurrencies like BCH. You will also need to install the appropriate software and can choose to join a mining pool where you collaborate with other miners to create new blocks.

Bitcoin Cash has several unique features:

- Larger block size: With a block size of 32 MB, Bitcoin Cash can process more transactions per second than Bitcoin.

- Lower transaction fees and faster processing times: Thanks to the larger block size, transaction fees are lower and transactions are processed faster than Bitcoin.

- Smart contract support: Developers can build dApps and protocols on the Bitcoin Cash blockchain thanks to smart contract support.

- Focus on transactions: Unlike Bitcoin, which is often seen as a store of value, Bitcoin Cash is more focused on its function as a means of payment.

Both Bitcoin and Bitcoin Cash are cryptocurrencies with their own blockchain. The main difference between the two is the block size. In 2017, Bitcoin Cash decided to increase its block size to 8 MB, while Bitcoin continued with a block size of 1 MB. This allows Bitcoin Cash to process up to 25,000 transactions per block, while Bitcoin has a maximum of 1,000 to 1,500 transactions per block.

The larger block size allows for faster processing times and lower transaction fees on Bitcoin Cash, making it better suited for everyday use and microtransactions.

Purchasing Bitcoin Cash is possible Bitvavo, an accessible platform for both new and experienced traders. To buy Bitcoin Cash, follow four steps:

- Log in or register with Bitvavo.

- Deposit euros by clicking "Deposit".

- Visit the Bitcoin Cash buy page.

- Enter the Euro amount or the number of BCH you want to buy and click "Buy".

After your purchase, the BCH tokens will be added automatically to your Bitvavo wallet, where you can manage and sell your Bitcoin Cash coins. This allows you to act quickly based on the latest market changes.

You can safely store your Bitcoin Cash tokens in your Bitvavo account. We keep the majority of customer funds in offline cold wallets for optimal security. We always recommend users to activate two-factor authentication (2FA) as an extra layer of security.

Want to store your BCH coins in a personal wallet? Most software and hardware wallets support Bitcoin Cash. Buy BCH and send it to an external wallet by first verifying the wallet address with your Bitvavo account.

* This is for informational purposes only and is not advice, nor should it be relied upon as such.

Direct Euro Transfers

Buying digital assets with Euros has never been easier. Bitvavo supports 8 payment methods, including SEPA for instant transfers.

Funding Methods →No Wallet Needed

Bitvavo manages your wallets and digital assets so you don't have to. Trade digital assets safely without technical knowledge.

Asset List →Security Features

Security is our top priority. Explore our security options and the measures we take to keep your account and our platform safe.

Our Security →Add Bitcoin Cash to your portfolio

Join over a million users buying and selling Bitcoin Cash at Bitvavo and enjoy our low fees and easy to use platform.

Sign up & Buy Bitcoin CashBitvavo B.V.

Trading digital assets involves significant risks. Digital assets are highly volatile and you may lose some or all of your investment. The information on this page does not constitute advice, and should not be relied upon as such. Bitvavo is authorized as a crypto-asset service provider under Regulation (EU) 2023/1114 (MiCA) by the Autoriteit Financiële Markten (AFM), Vijzelgracht 50, 1017 HS Amsterdam. More info can be found in our Risk Disclosure.

Bitvavo is registered at the Dutch Chamber of Commerce, number 68743424.