Buy Acala Token

Buy Acala Token safely and easily at one of Europe's leading exchanges.

Low trading fees: 0.25%

Buy Acala Token with 8 payment methods

Acala Token wallet included

* Be aware that digital assets are highly volatile and investing in digital assets can lead to partial or total loss of your investment. Carefully assess your own situation, conduct your own research and only invest in digital assets with money you can lose. Past performance is no indication of future performance.

400+

1.5M+

100B+

4/5

Intuitive Mobile App

Download our mobile app to buy cryptocurrency instantly from your phone. Manage your digital assets from your phone anytime, anywhere.

Legal Compliance

Bitvavo is registered with De Nederlandsche Bank (DNB), the Dutch Chamber of Commerce, and complies with all relevant legislation.

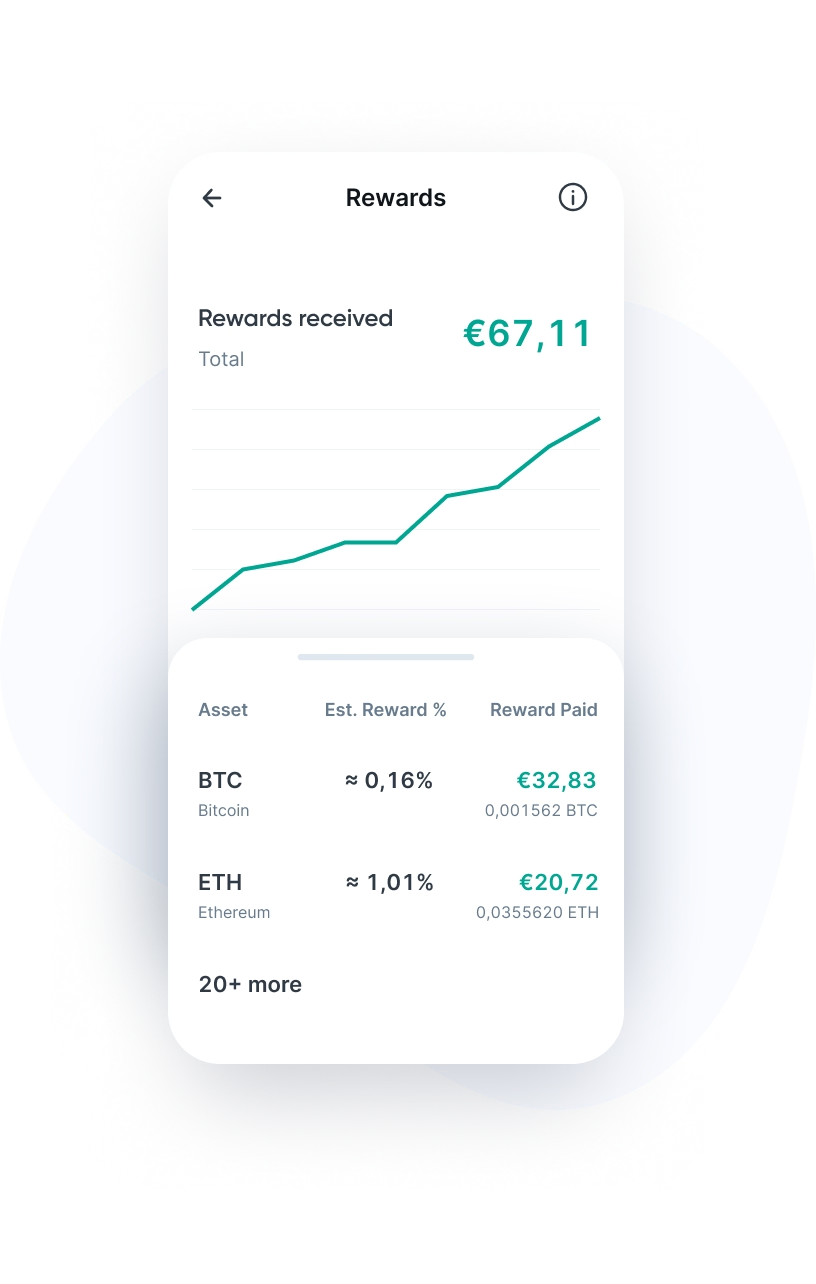

Staking Rewards

Bitvavo enables you to earn a return on your digital assets. Our staking service offers a yield of up to 15% on staked assets.

Frequently Asked Questions

Bitvavo makes Acala Token as easy as possible. Here are answers to common questions to help you make your first steps in the world of digital assets.

Acala Token (ACA) is the native token of the Acala network, a decentralized financial hub built on the Polkadot ecosystem. Acala is designed as a cross-chain DeFi platform and liquidity hub, focusing on both decentralized and centralized finance, also known as HyFi (Hybrid Finance). The platform aims to create a sustainable liquidity layer supporting both crypto and real assets, providing a versatile solution for the world of Web3 finance.

A key feature of Acala is its compatibility with the Ethereum Virtual Machine (EVM), allowing developers familiar with Ethereum to easily build and use their decentralized applications (dApps) on the Acala network. This enables both existing and new dApps to run on Polkadot without complex modifications.

One key function of Acala is the Universal Asset Hub, where various multichain liquid staking token (LST) protocols converge. Users can stake DOT tokens and convert them into liquid DOT (LDOT), a tradable version of staked DOT. LDOT can be used within the network for DeFi activities such as borrowing, lending, or as collateral for other investments.

Acala offers a decentralized exchange called Acala Swap, using an Automated Market Maker model. Users can trade assets automatically without a central exchange. Acala Swap is fully integrated with Polkadot, allowing assets to be traded between different parachains to enhance liquidity in the ecosystem.

Acala has its own stablecoin, the Acala Dollar (aUSD), which is pegged to the US dollar and backed by crypto assets like DOT, Bitcoin (BTC), and Ethereum (ETH). The aUSD protocol, known as Honzon, uses a collateral mechanism to maintain stability, valuable for users seeking price stability in the volatile crypto market. Acala's Homa protocol keeps staked assets liquid through an algorithmically adjusted strategy, allowing users to manage their investments flexibly.

Who founded Acala Token?

Acala Token (ACA) was founded in 2019 by a team of blockchain experts with diverse backgrounds, including Bette Chen, Bryan Chen, Fuyao Jiang, and Ruitao Su. Bette Chen has a strong background in product development and software engineering, while Bryan Chen and Fuyao Jiang have deep knowledge of blockchain technology and development strategies. Together, they work from the company Laminar, responsible for managing and developing the Acala network and contributing to the growth of the Polkadot ecosystem.

Acala Token (ACA) offers various functions and capabilities for both end users and developers in the ecosystem. This provides a versatile solution for various financial applications:

- Transaction fees: ACA is used to handle transactions within the Acala network, giving users access to different DeFi services.

- Governance and voting: ACA holders can vote on important network decisions, such as protocol updates and economic parameters, giving users influence over the platform's future.

- Liquid staking: Users can stake their DOT tokens in exchange for liquid DOT (LDOT), earning additional returns while still using their staked assets within the network.

- dApp development: Developers can use ACA to implement smart contracts and build dApps on Acala's EVM-compatible platform, benefiting from interoperability with Polkadot.

- Network stability: ACA serves as a backup mechanism during volatility to ensure network stability, crucial for the ecosystem's reliability.

Acala Token (ACA) operates on the Polkadot network, utilizing a technology stack with advanced components to ensure scalability, security, and interoperability.

The Universal Asset Hub is a crucial part of Acala, offering a multichain liquid staking token (LST) protocol like LDOT, integrated into the Polkadot ecosystem. Users can stake tokens without losing liquidity, allowing their assets to be used for other financial activities while still earning staking rewards.

Honzon: The stablecoin protocol

Honzon is the protocol behind Acala Dollar (aUSD), a stablecoin pegged to the US dollar. It operates on a collateral basis, allowing users to stake crypto assets like DOT, BTC, and ETH. In case of collateral devaluation, an off-chain service called the 'Off-Chain Worker' automatically liquidates risky positions to maintain system stability. This system of collateralized debt positions (CDPs) aids in stabilizing the value of aUSD.

Homa: Liquidity and staking

Acala's Homa protocol offers a liquidity layer through an algorithmically adjusted staking strategy. Users can stake DOT to receive LDOT, which is tradable within the Polkadot ecosystem. LDOT can be exchanged for DOT at any time, allowing holders flexibility to benefit from staking without long lock-ups.

Integration with the Ethereum Virtual Machine (EVM)

An important benefit of Acala is its compatibility with the Ethereum Virtual Machine (EVM). This allows developers familiar with the Ethereum ecosystem to easily create and run dApps on Acala without needing to learn new technologies. This enhances accessibility for a wider group of developers and strengthens interoperability between Ethereum and Polkadot.

Security through Polkadot's relay chain

Acala benefits from Polkadot's shared security layer, the relay chain. This layer provides extra protection by having all parachains within the Polkadot ecosystem, including Acala, share the same security model. This reduces the risk of attacks and strengthens the network's resilience against threats, enhancing the overall ecosystem security.

Acala Token offers unique and innovative features that set the project apart in the blockchain and DeFi space. Here are five key features that make Acala truly special:

- HyFi integration (Hybrid Finance): Acala combines decentralized and centralized financial structures, providing users with access to a wide range of financial services, from traditional CeFi products to innovative DeFi solutions.

- Universal Liquidity Layer for Web3: As Polkadot's liquidity hub, Acala offers a universal layer supporting liquid staking and cross-chain transactions, creating a fully connected DeFi ecosystem.

- First stablecoin on Polkadot (aUSD): Acala's stablecoin, aUSD, is the first stable cryptocurrency on Polkadot, backed by crypto assets and designed specifically for the Polkadot ecosystem, offering stability and ease of use on one network.

- Crowdloan funding model: Acala secured its parachain slot through a unique crowdloan model, where the community backed the project with DOT to operate on Polkadot, showcasing an innovative and inclusive financing approach.

- Acala EVM+: An advanced EVM environment: Acala's custom EVM (EVM+) not only offers EVM compatibility but also Polkadot-specific functionalities, allowing dApps to operate on both Ethereum and Polkadot without limitations.

You can buy Acala Token (ACA) on Bitvavo, a platform suitable for both beginners and experienced traders. Follow these steps to buy ACA through our website or app:

- Sign up or log in to your Bitvavo account.

- Click "Deposit" to make a deposit.

- Head to the purchase page of Acala Token.

- Enter the amount in euros or choose the number of tokens you want to purchase, and click "Buy".

The purchase price of Acala Token is directly linked to the current market rate. After the transaction, the tokens will be automatically added to your Bitvavo account, where you can easily manage or trade them. This allows you to quickly and efficiently react to price movements.

You can easily store your Acala Tokens securely in your Bitvavo account. The majority of funds are stored in offline cold storage for extra security. We recommend enabling two-factor authentication (2FA) for added security by requiring an extra code when logging in.

You can store Acala Tokens in many software and hardware wallets. To transfer your ACA tokens to an external wallet, verify the wallet address in your Bitvavo account to securely send the tokens. This way, you can safely store your Acala Tokens in the location that best suits your needs.

* This is for informational purposes only and is not advice, nor should it be relied upon as such.

Direct Euro Transfers

Buying digital assets with Euros has never been easier. Bitvavo supports 8 payment methods, including SEPA for instant transfers.

Funding Methods →No Wallet Needed

Bitvavo manages your wallets and digital assets so you don't have to. Trade digital assets safely without technical knowledge.

Asset List →Security Features

Security is our top priority. Explore our security options and the measures we take to keep your account and our platform safe.

Our Security →Add Acala Token to your portfolio

Join over a million users buying and selling Acala Token at Bitvavo and enjoy our low fees and easy to use platform.

Sign up & Buy Acala TokenBitvavo B.V.

Trading digital assets involves significant risks. Digital assets are highly volatile and you may lose some or all of your investment. The information on this page does not constitute advice, and should not be relied upon as such. Bitvavo is authorized as a crypto-asset service provider under Regulation (EU) 2023/1114 (MiCA) by the Autoriteit Financiële Markten (AFM), Vijzelgracht 50, 1017 HS Amsterdam. More info can be found in our Risk Disclosure.

Bitvavo is registered at the Dutch Chamber of Commerce, number 68743424.